Follow us on Telegram and on Instagram @humanresourcesonline for all the latest HR and manpower news from around the region!

share on

There are many countries with a significant leadership gap for women, and these are often in Asia, Africa and Latin America.

The primary drivers contributing to gender-based wealth disparity are gender pay gaps and delayed career trajectories, according to WTW's 2022 Global Gender Wealth Equity Report.

The WTW Wealth Equity Index (WEI), developed in collaboration with the World Economic Forum, looked holistically at gender inequities across women’s lifetimes and attempts to quantify the extent of the gender wealth gap for a selection of markets globally. It analysed both quantitative and qualitative aspects of gender wealth equity, with deep dives into 39 markets. It found that there is a gender wealth gap consistently across all countries globally (although the level varies), and the average global index is 0.74, which means that upon retirement, women are expected to only accumulate 74% of the wealth that men have.

Here's what you need to know from the report.

Globally

The Wealth Equity Index (WEI) found widely varying gaps in women’s accumulated wealth at retirement by country compared to men. It substantiates that women are at considerable disadvantage in the accumulation of wealth at the end of their careers.

Globally the indices calculated a range of 0.60 in Nigeria, 0.61 in Argentina, 0.63 in Mexico and Turkey to 0.84 in Austria, 0.86 in Spain and 0.90 in South Korea. In between these extremes, there is a middle ground occupied by most countries. Regionally, it found that Europe, Asia Pacific, and North America had the higher WEIs.

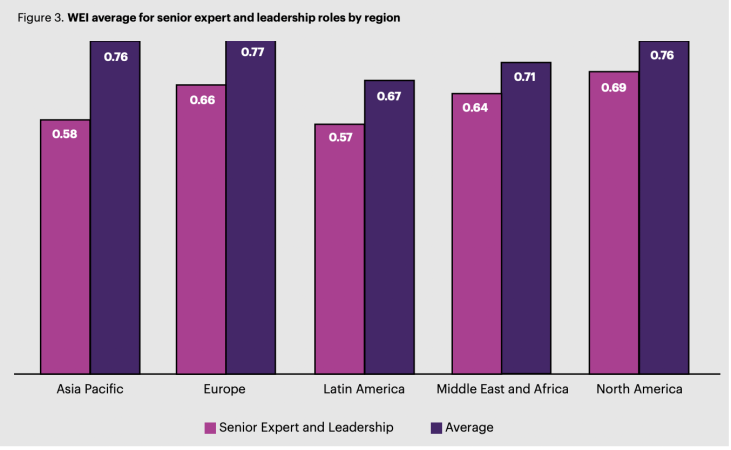

The global analysis also considered specific personas from the working population, based on job roles. For frontline operational roles, the overall gender wealth gap averages 11%. For professional and technical roles, the gap nearly triples, averaging 31%, and for senior expert and leadership roles, it grows further to an average of 38%.

According to the research, women in leadership roles are affected disproportionately in terms of accumulated wealth at retirement relative to their male counterparts. Additionally, there are many countries with a significant leadership gap for women, and these are often in Asia, Africa and Latin America.

Asia Pacific

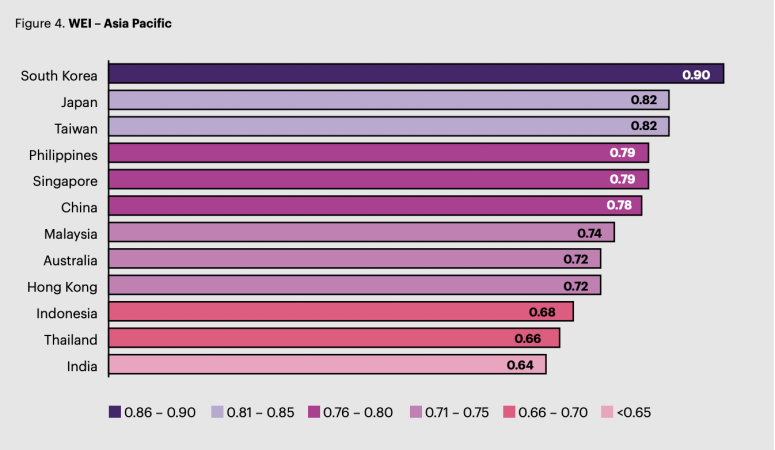

Asia Pacific shows considerable differences in expected wealth accumulation at retirement, and different progress made towards gender wealth equity across the region.

Toward the lower end of the global findings is India. In terms of career, the research found significant gender pay gaps in India that exceeded the global average, particularly for professional and technical roles, as well as senior expert and leadership roles. Opportunities for women in leadership positions are also limited, with only 3% of women in the workforce occupying senior positions.

On the other hand, South Korea stood out not just in the region but globally, followed by Japan and Taiwan. Singapore fared favourably with a score of 0.79 as did the Philippines and China with a score of 0.78. Malaysia followed with a score of 0.74, surprisingly all surpassing both Hong Kong and Australia with scores of 0.72.

Across Asia Pacific, seven markets included in the analysis have WEIs that are at least equal to the global average. Similar to South Korea, these results can be attributed to benefit and salary caps embedded in the social security and mandatory retirement benefit systems.

Europe

The Wealth Equity Index was measured in 14 countries in Europe with an average WEI of 0.77, the highest average among the regions studied. It ranged from 0.70 for the Netherlands to 0.86 for Spain. Eleven out of the 14 countries have an average WEI of at least 0.74, the global average.

Eleven out of the 14 countries studied are current members of the European Union (EU), which counts gender equality as one of its founding values. However, despite this, and even though the situation has improved over the last decade, there is still a significant gender pay gap in the EU of 13%5 .

In the Netherlands, there is a greater disparity in wealth equity for women across all levels. While in Spain, the accumulation of wealth for women in frontline operational roles is almost at par with men as their pay levels are also almost at parity.

In the region, the lack of family support to care for a child has a large impact on women’s capacity to build retirement wealth in the U.K., Germany and Italy.

Latin America

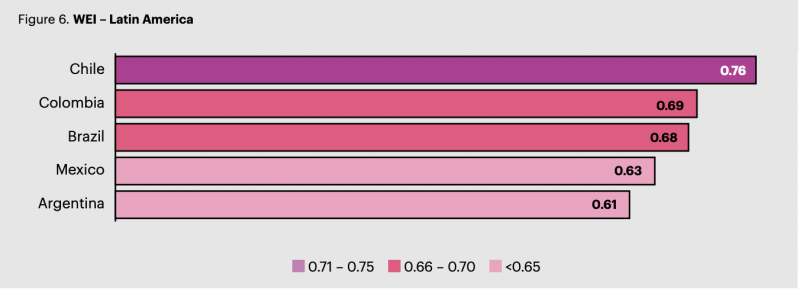

Despite the improvements shown in recent years, in part due to government regulations that attempt to enshrine equal labour and social rights between genders, Latin America presents low indices of gender wealth equity. WEIs across the region range from 0.61 in Argentina to 0.76 in Chile and average 0.67, considerably below the global average.

Chile is the best performer in the region among the countries analysed. However, in Argentina and other countries affected by hyperinflation, wealth accumulation is further impeded by high levels of inflation which erode the real value of savings.

Women in Argentina also have relatively low financial literacy, whereas financial literacy for women in Chile is much higher, resulting in a better expected return on invested wealth for women in Chile relative to men.

Middle East and Africa

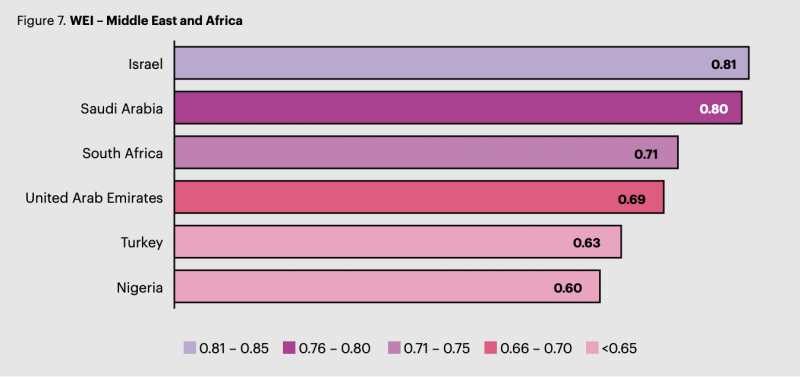

Along with Latin America, the Middle East and Africa constitute the lowest indices of gender wealth equity globally. The region is also home to Nigeria, the poorest performing country on this metric included in the analysis. Overall, the indices range from 0.60 for Nigeria to 0.81 for Israel.

In Nigeria, wealth accumulation for women is hindered by career and pay gaps, worsened by having children, and compounded by a high inflation environment. Further, there is a void of employer-funded retirement plans in Nigeria.

Regionally, Israel performed best. For Israel, a significant portion of wealth is derived from state and mandatory programmes, which consist of a combination of flat rate benefits and salary related benefits with earnings caps. This serves to limit the wealth accumulation of men relative to women, and subsequently improve the Wealth Equity Index.

For the Middle East specifically, Saudi Arabia and U.A.E were included in the analysis. The WEI for Saudi Arabia was determined to be 0.80, whereas the WEI for the U.A.E was substantially lower at 0.69.

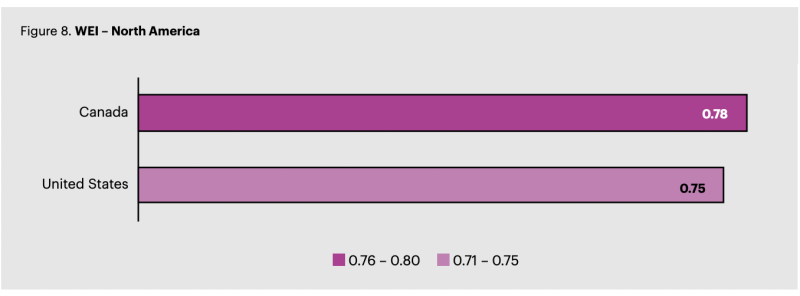

North America

Similar to Europe, the indices for the United States and Canada are above the global average. In both markets, pay gaps and delayed career progression are the primary drivers of the wealth disparity between men and women. The pay gap is more pronounced for women in leadership roles, where the pay trajectories for women are significantly lower than men.

In the U.S., caregiving had similar impacts on men and women. In particular, Canadian women take more time off at lower pay replacement ratios to care for babies (under mandatory maternity leave programmes) versus American women who are assumed to receive full pay replacement while on a shorter maternity leave.

All images / WTW

share on