share on

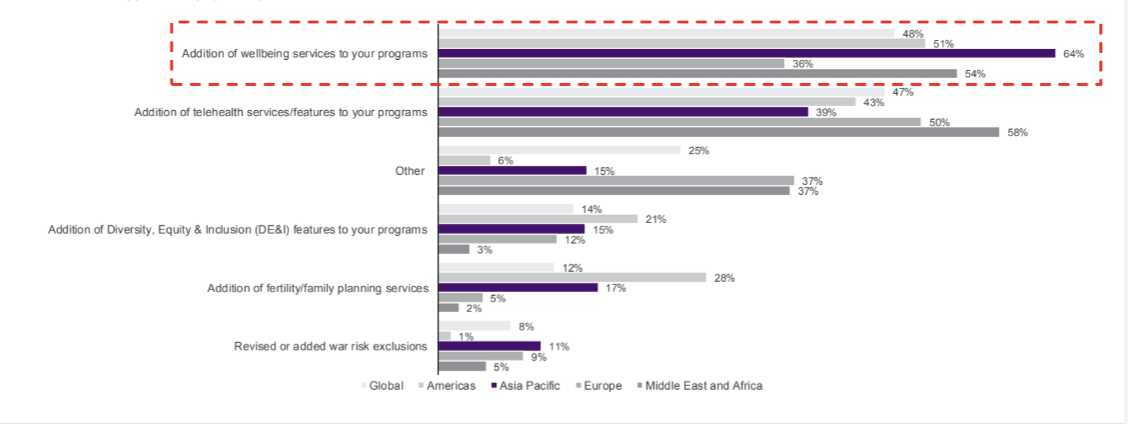

In 2024, 64% of insurance companies surveyed in the region have added wellbeing services into their medical portfolio.

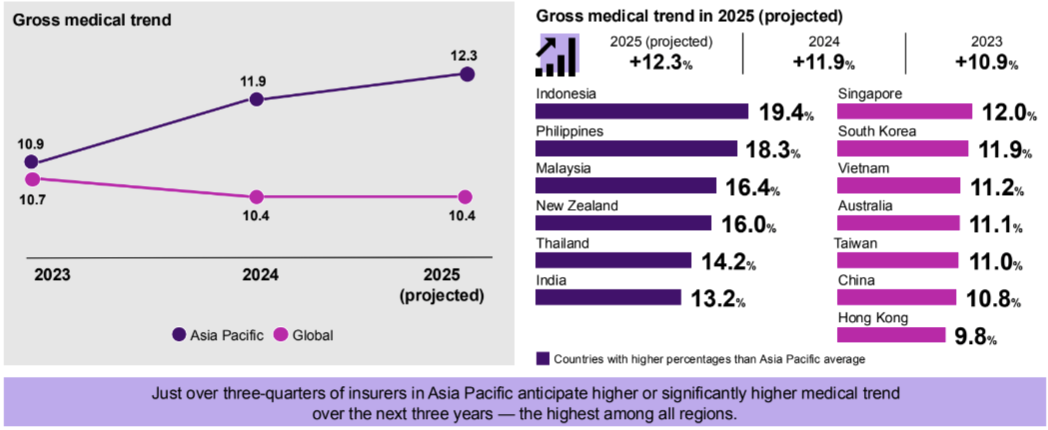

The Asia Pacific (APAC) region is forecasted to experience the highest global medical inflation globally in 2025, at 12.3%. This marks the region's third consecutive year witnessing double digits.

According to the WTW Global Medical Trends Survey, released at a media briefing attended by HRO, this projected increase surpasses the previous year’s rate of 11.9%. While the trend shows signs of slight cooling, it is expected to remain elevated in the longer term.

The data broken down by market is as follows:

*Blue = higher than APAC average; pink = lower than APAC average

- Indonesia: 19.4%

- Philippines: 18.3%

- Malaysia: 16.4%

- New Zealand: 16%

- Thailand: 14.2%

- India: 13.2%

- Singapore: 12%

- South Korea: 11.9%

- Vietnam: 11.2%

- Australia: 11.1%

- Taiwan: 11%

- China: 10.8%

- Hong Kong 9.8%

Commenting on Singapore's figures, Audrey Tan, Head of Health & Benefits, Southeast Asia and Singapore, WTW said: "Singapore’s medical inflation rate seems to be moving into a stable trend in 2025. The government also remains invested in improving the health of its population."

"It is therefore important for companies to focus on workforce wellbeing, with high emphasis on preventive care. The focus is to build a future-ready workforce that is ready for challenges ahead, especially to cater for the varying demographics in today’s workplace."

However, more than three-quarters (76%) of APAC insurers surveyed anticipate a significant rise in medical costs over the next three years. Nearly two-thirds (62%) also foresee higher demand for healthcare services during this period, highlighting ongoing pressures on medical care systems in the region.

Key factors that are influencing the medical trend rates

Nearly three in five APAC insurers attribute increases to an even split between utilisation and unit price

Globally, insurers face rising medical costs driven by increased utilisation and unit prices. In APAC, three in five (57%) attribute this equally to both factors.

Internal drivers of medical costs are perpetuated by behaviours of healthcare providers and insured members. The top factor reported is medical practitioners recommending too many services (79%), including overprescription of both medications and diagnostics, which results in what were noted as unnecessary and excessive costs.

External factors include the healthcare cost drivers this year include higher cost of new medical technologies (73%), the continued pressure being placed on private healthcare providers as public healthcare systems are overwhelmed (40%), and limited cost-sharing in plan designs (39%), which leaves many employees to turn to and rely on private medical providers.

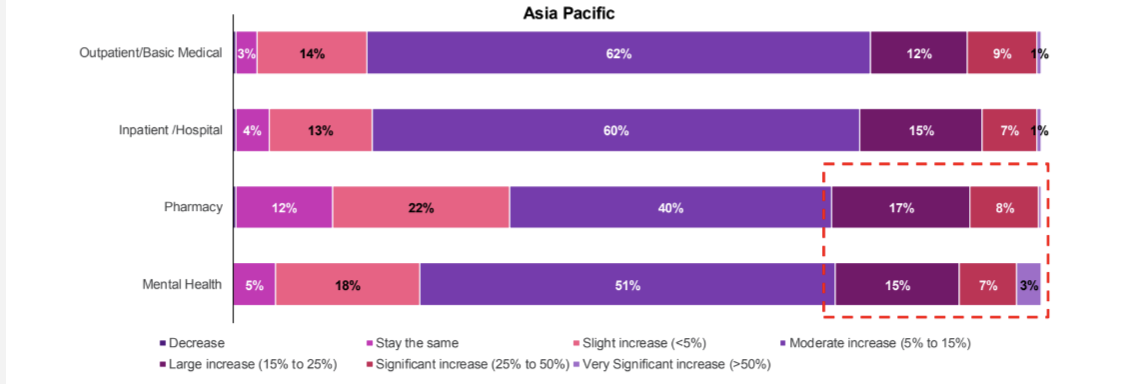

Pharmacy and mental health costs are more likely to increase significantly in APAC

Mental health and pharmacy costs are expected to grow significantly in APAC, with one-quarter of insurers projecting an increase in pharmacy expenses over the next three years. "High pharmacy costs can be attributed to the ageing population and increase in chronic diseases among the population in many of the Asian markets, such as Singapore; high cost of new pharmaceuticals and biologics for advanced therapies treatments; adoption of expensive medication that is perceived as branded and more superior to generic medicines; and issues with supply chain and inflation," added Audrey.

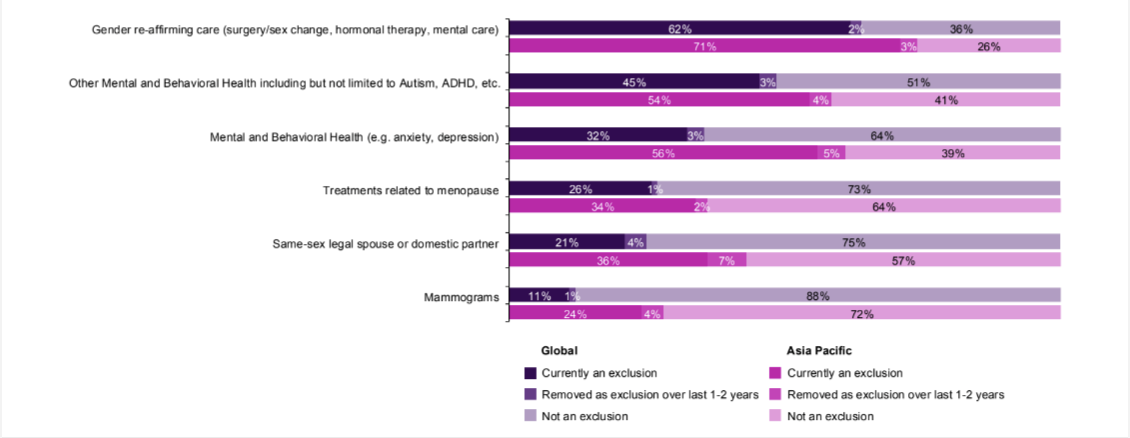

The demand for mental healthcare is also rising, yet only 4% of insurers in APAC have removed exclusions for such conditions in their medical portfolios over the past one to two years.

"Mental and behavioural health conditions remain the fastest growing conditions globally, except in APAC. In many markets here, it is still a standard exclusion in medical plans and considered a stigma where employees are not seeking help.

"Although more insurers in Hong Kong and Singapore have included mental health or removed exclusions of the condition in their medical portfolios, more needs be done," said Royston Tan, Head of Health & Benefits, Asia Pacific, WTW (pictured above).

The persistent double-digit rise in medical costs presents ongoing challenges for employers. As Royston affirmed, employers must prepare for escalating expenses while ensuring they maintain adequate care for employees. He suggested focusing on initiatives such as promoting preventive care, evaluating vendor solutions, and expanding wellbeing programmes. These measures aim to empower employees with resources to prioritise their health and access quality, affordable, patient-centric care.

"The objective is to provide employees more resources to understand the importance of taking care of their own health, supported by quality patient-centric care at an affordable price."

What is driving the cost increase?

The survey findings revealed the following cost drivers:

- Higher costs due to new medical technologies (73%)

- Decline in quality or funding of public health systems (40%)

- Plan design with little or no cost-sharing (39%)

- Higher costs due to advancements in pharmaceuticals (26%)

- Too few providers available (24%)

Royston shares: "What drives medical costs is, simply put, demand and supply.

"We simply do not have enough supply-wise, but demand is increasing exponentially. And (if) you put these two together, not enough supply in terms of trained physicians, mental care specialists, and increasing demand, then it (becomes) a recipe for higher costs."

It was also highlighted:

- Insurers in APAC are more concerned about the lack of cost sharing in plan design

- Member coinsurance is the most typical cost sharing approach in APAC vs a much higher of adoption in other approaches globally

- Cancer, cardiovascular and musculoskeletal are the top conditions by cost

- Mental health continues to be one of the fastest-growing condition globally except for APAC

When asked about the rising mental health concerns across the APAC region, Royston observed that increased awareness in recent years, particularly in Asia, has led to a decrease in the social stigma surrounding mental health. He pointed to social media as an example, where media personalities and influencers are increasingly open about their mental health struggles, helping to normalise these experiences.

"Also we see certain segments of (the) population being more open to it, and employees (are) also being more open to address it, and providing a safe space, providing anonymous support. It's certainly a very positive trend and development," he stated.

On the flipside, he emphasised the challenge observed across the region is the lack of trained clinicians, psychologists, psychiatrists, and therefore there is not enough care support in medical conditions such as autism and ADHD, and therefore a longer waiting time at the clinic.

"I can share that in a private sector, to be diagnosed with ADHD will easily cost north of five to 8,000 Singapore dollars, because there's a battery of tests, battery of questionnaires, and then you need an occupational therapy person."

Audrey echoes this point by sharing an example of one insurance company that "identified and recognised that mental health is also treated as one condition of diagnosis, one sickness." This company now allows employees to submit a single condition with a required referral letter, treating mental health as any other disability.

Medical trends by country

India

Medical inflation in India is projected to range between 10% and 15% in 2025, continuing trends from previous years. This increase is driven by rising healthcare demand, escalating costs of pharmaceuticals and medical technology, and broader economic factors.

As a result, insurers may need to adjust premium rates to balance profitability amid the anticipated surge in healthcare costs.

Indonesia

In Q1 2024, Indonesia's average claims loss ratio hit 105.7% and is expected to rise further in 2025. Global medical inflation, driven by costly pharmaceutical raw materials and medical equipment, along with a weakening local currency, has increased healthcare expenses.

To manage costs, insurers are raising premiums, reviewing health products, and shifting focus to SMEs, as large corporations with comprehensive benefits pose higher underwriting risks. Rising costs are compounded by hospitals recommending excessive services using advanced medical technologies.

In response, insurers are adopting reimbursement payment methods, which cost 15% to 35% less than cashless systems for similar treatments.

Malaysia

Malaysia’s push to become a top medical tourism destination is driving up healthcare costs due to infrastructure, technology, and training investments. While affordable, high-quality care attracts international patients, public hospitals face overwhelming demand, forcing many to turn to private hospitals.

Lifestyle changes have fuelled a rise in non-communicable diseases like diabetes, hypertension, and cancer, further straining resources. Costs are also impacted by rising healthcare wages and limited pricing transparency, prompting calls for the Health Ministry to regulate private hospital charges.

From 1 September 2024, insurers must implement cost-sharing schemes to lower premiums and increase patient cost awareness. Additionally, telehealth, virtual consultations, and specialised medical devices are being introduced to promote proactive health management.

Singapore

Singapore’s medical inflation rate is stabilising for 2025, driven by high real estate costs, rising healthcare talent expenses, and its status as a medical hub in APAC. The Ministry of Health continues to prioritise workforce wellbeing and preventive care.

Through the updated Industry Transformation Map 2025, Singapore aims to digitise healthcare, leverage data for research, and attract healthcare talent. These efforts focus on building a future-ready healthcare workforce and ensuring affordable, patient-centric care for diverse workplace demographics.

Philippines

The Philippines’ Health Maintenance Organisation (HMO) industry faced significant losses, escalating from PHP 1.433bn (USD 25mn) in 2022 to PHP 4.269bn (USD 75mn) in 2023, due to rising claims and benefits paid.

To counter increasing utilisation trends, HMOs have adjusted pricing assumptions annually, with medical inflation rates of 15% to 18% over the past three years.

Key drivers include higher hospital and clinic costs, increased professional fees, and a surge in disease frequency. Claims frequency now exceeds pre-pandemic levels, with costs per claim rising due to more expensive medical services and procedures.

Looking ahead

As companies look towards 2025, here are some emerging trends that insurance companies are anticipating:

Addition of wellbeing services is the biggest change made by insurers in APAC

Exclusions on DEI-related benefits

And here are some key considerations that employers can take note of:

- Promote preventive care by facilitating and encouraging opportunities for screenings, early detection measures, vaccines and educational sessions/campaigns

- Ensure benefits are fit for purpose by reviewing programmes to identify opportunities and eliminate unnecessary or underutilised coverage

- Evaluate vendor solutions and consider programmes that target certain chronic conditions and provide support services and behavioural intervention

Infographics: Provided by WTW

Lead image / Journalist's own

share on

Follow us on Telegram and on Instagram @humanresourcesonline for all the latest HR and manpower news from around the region!

Related topics