share on

While Malaysia companies are more likely to tap on insurance providers for their employee medical benefits, those in Singapore tend to use self-managed reimbursement.

As healthcare continues to become a key priority everywhere, more employees identify employee wellbeing as a key deciding factor when applying for a new job. Companies are, therefore, being prompted to re-examine and adapt their current policies to complement national measures, ensuring optimum employee attraction and retention.

For a better understanding of this trend, Mednefits recently launched its 2022 Employee Benefits Trends e-book detailing its findings based on a survey of 200 HR decision-makers in Singapore and Malaysia regarding medical benefits as well as insights into the challenges of administering employee benefits.

As the e-book covers, employee benefits typically comprise two broad categories: medical and flexible benefits.

Medical benefits, it was defined, including medical, dental, health, hospital, and disability benefits provided under any and all benefit policies, plans, programs or arrangements of the employer. Per the study, medical benefits generally have two categories: inpatient and outpatient.

Meanwhile, flexible benefits allow employees to choose their preferred benefits from a pool of options set by the employer. Potential options include increasing EPF or CPF percentage contributions, leave amount, and comprehensive insurance. Options offered are often determined by the management upon seeking opinions from employees to attain the highest satisfaction rate. Some examples include transportation, gym memberships, meal subsidies, and loan support.

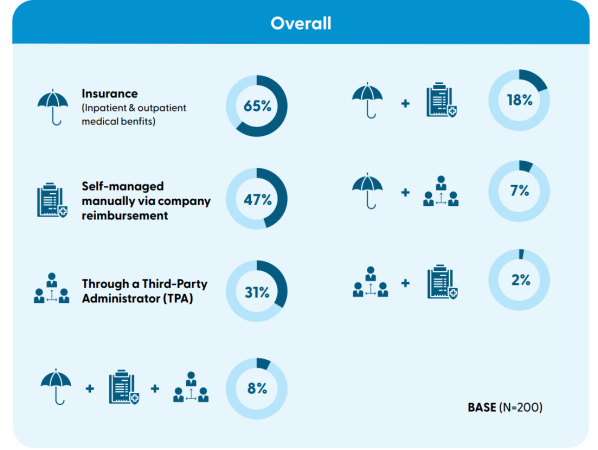

Currently, there are several different ways companies in Singapore and Malaysia administer their employees' medical benefits. The most common method is by using an insurance provider for inpatient and outpatient medical benefits (65%). Less than half of the companies are self-managing the benefits or going through a third-party administrator.

Next, nearly one in five companies are using both insurance and self-managed benefits. The reason being that their insurance providers might not have all the medical benefits that they want, or insurance is too expensive to cover, the study noted. Thus, the companies employ reimbursement systems and processes for some of the medical benefits.

There are significantly more companies in Malaysia (74%) that administer their medical benefits via insurance providers than those in Singapore (55%). Meanwhile, more companies in Singapore provide manually self-managed medical via company reimbursement (48%), compared to Malaysia (46%).

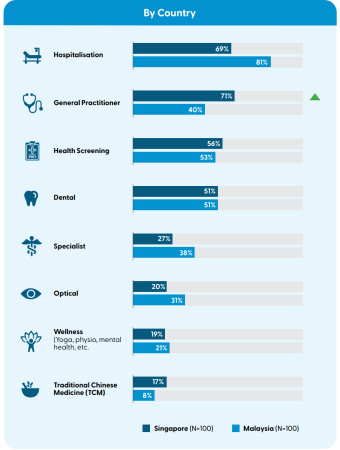

The top three most common medical benefits overall across Singapore and Malaysia provided are:

- hospitalisation (75%),

- general practitioner (56%), and

- health screening (55%).

On the other hand, the least common are:

- optical (26%),

- wellness (20%), and

- traditional Chinese medicine (13%).

By country, hospitalisation benefits were more common in Malaysia (81%) than in Singapore (69%). However, more organisations in Singapore (71%) cover expenses for general practitioners than in Malaysia (40%).

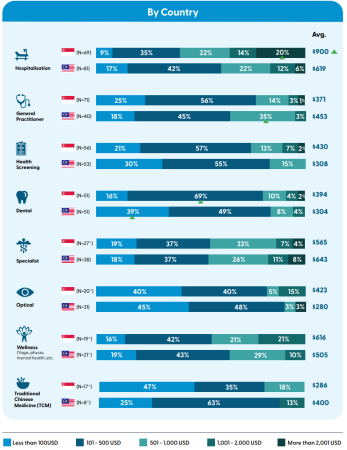

The study also took a deeper look into the amount spent on the various ways of providing medical benefits.

In line with previous trends, organisations are spending the most (USD565) per employee on insurance. On average, organisations spend the least (USD480 ) per employee via reimbursement.

By benefits, the amount spent by companies per employee is the highest on benefits such as hospitalisation & specialists.

Taking a market-specific look, the study revealed the following:

- In Singapore, the amount spent per employee is the highest on hospitalisation benefits, with 20% of organisations spending more than USD2000.

- Similarly, the per-employee spend in Malaysia on hospitalisation benefits is "relatively high"; while "a significant" 35% of organisations spend USD501 - USD1,000 per employee on general practitioner benefits.

Following the cost factor related to each benefit category type and benefits administration method type, another concern would be related to the amount of administrative work required to implement and manage the benefits policy. On average, companies have allocated approximately five resources for administering & overseeing medical benefits.

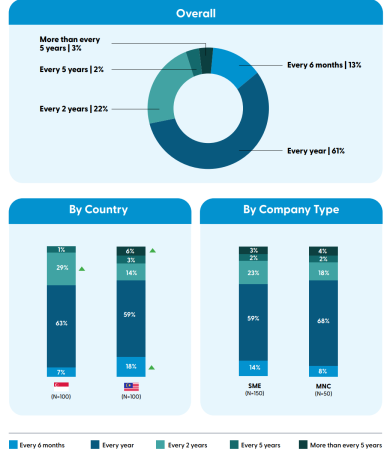

In terms of the frequency of evaluating medical benefits policy, companies mostly review & re-evaluate their medical benefits policy every year. While more organisations in Malaysia re-evaluate their policies every six months, a significantly higher proportion of companies do so every two years in Singapore.

Last, the survey also looked into employers' concerns. Overall, the number one concern across organisations was designing a flexible benefits plan that is customised for employees (34%). This was then followed by the increasing cost of healthcare plans and premiums (28%), and administrative burden for managing benefits and claims (22%).

Photo / Mednefits 2022 Employee Benefits Trends

Follow us on Telegram and on Instagram @humanresourcesonline for all the latest HR and manpower news from around the region!

share on

Follow us on Telegram and on Instagram @humanresourcesonline for all the latest HR and manpower news from around the region!

Related topics