Follow us on Telegram and on Instagram @humanresourcesonline for all the latest HR and manpower news from around the region

share on

A data architect could earn between RM10,000 to RM20,000, while an experienced GM/operations director in manufacturing could be taking home RM20,000 to RM40,000 a month.

As we settle into 2023 with renewed lenses and optimism for a better year ahead, what's in store for Malaysia's high-growth industries?

Released today (Tuesday, 17 January 2023), Randstad Malaysia's 2023 Job Market and Salary Trends Report highlights the following industries: Information technology, manufacturing, and construction, noting that these industries could see talent and skills development becoming a key focus for employers this year.

On that note, this article highlights the expected salaries in selected roles, talent trends in individual industries, and most in-demand roles derived from the report, as follows:

Information Technology

Salary snapshot

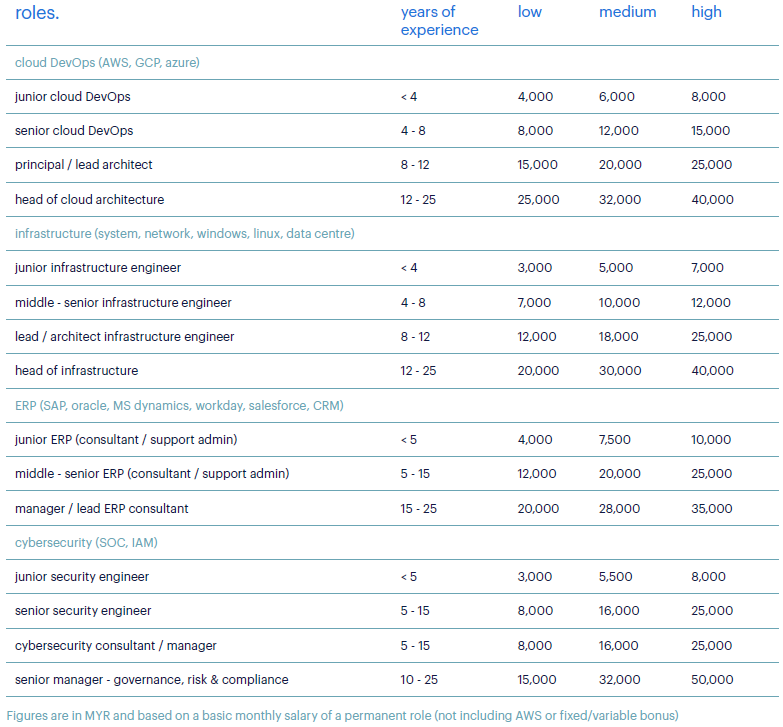

Enterprise roles

A senior manager - governance risk & compliance, who comes with 10-25 years of experience, can expect to earn somewhere from RM15,000 to RM50,000 a month; while a head of cloud architecture, with 12-25 years of experience, can earn RM25,000 to RM40,000 a month. Full list:

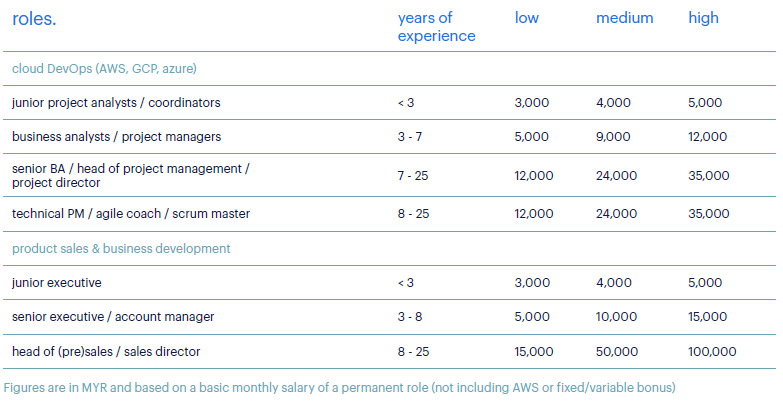

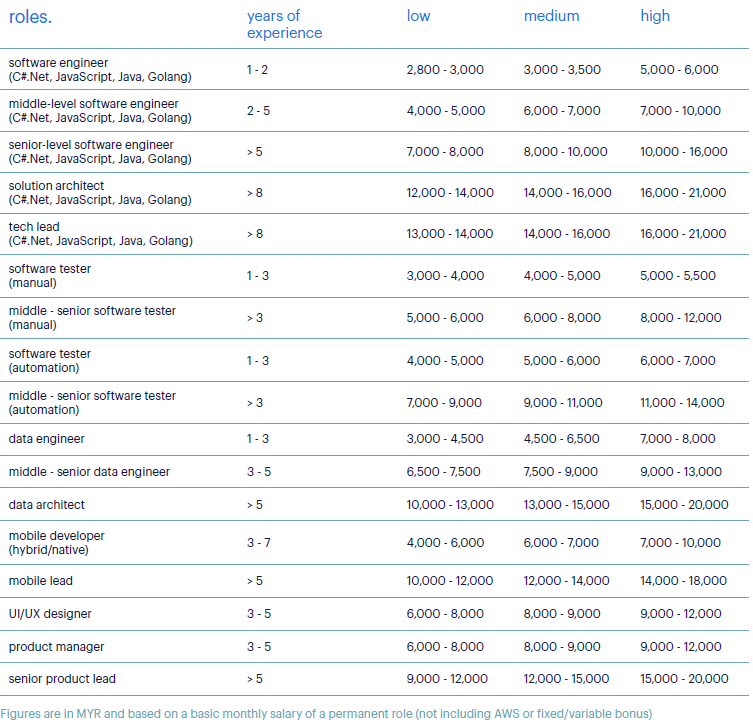

Development roles

Looking at development roles, a data architect with more than five years can be earning a monthly pay of between RM10,000 to RM13,000; RM 13,000 to RM15,000, or the higher range of RM 15,000 to RM20,000. Full list:

Talent trends

5G will drive talent hiring

The 5G rollout in Malaysia, which is underway, is expected to further advance web evolutions and create an estimated 39,000 value-add jobs, as cited in the report. The 5G implementation, led by Digital Nasional Berhad (DNB), will provide an enabling environment to grow the local digital economy.

"With the nation’s major mobile carriers on board, we anticipate a boost in talent and business demands to test out the full capabilities of the country’s 5G infrastructure. Already, companies are driving up the demand for 5G-specific technical professionals like network and infrastructure project managers in manufacturing, transportation, finance, and retail."

Changing business demands in the tech space

Tech giants and unicorns announced retrenchments and hiring freezes toward the second half of 2022. Some companies have attributed recent restructuring to a poorer economic outlook as well as over-hiring and inflated wages, which had diluted overall profitability and productivity.

These changes, the report pointed out, can be seen as a reflection of how business demands have changed over the course of the pandemic. Now that the pandemic is behind us, business leaders are course-correcting their growth plans and focusing their resources on products and solutions that would define them as a company as well as drive higher returns. Resource optimisation would be a key priority as employers evaluate skills requirements much more closely.

In that vein, a slowdown in hiring activities is anticipated in H1 2023, as companies focus their hiring strategies on more highly skilled technologists to gain a stronger advantage and competition in the market. Employers will also have a greater focus on workforce retention to continue service delivery.

Last, the report highlighted that tech professionals working on older technology, legacy systems, or projects that are at risk of being phased out in the face of Web3 and 5G developments, will need to find internal upskilling and mobility opportunities to retain their job security.

Rethinking hiring strategies in the race for IT talent

On a more positive note, these business restructurings have created ‘market downtime’ that allows tech talent to pursue new careers and projects to expand their portfolios and acquire new skills, the report noted. Some software developers and web designers are freelancing for smaller projects or creating their own, which would further hone their skills and make them more attractive to employers. This may lead to an ‘open source’ job market, where technical employers evaluate projects in the marketplace to find their next hire instead of going through the normal interview process.

Hiring trends are often cyclical and seasonal and shall pass. Based on what we have observed over the years, these hiring trends—layoffs and hiring freezes—are part of the cycle that tests a company’s resilience and adaptability. Businesses prepared for radical changes will be the first to find opportunities in obstacles. Start-ups developed ride-hailing services and super apps because of changing customer behaviours and demands. This has motivated other companies, like those in financial and travel services, to expand their digital and mobile offerings.

To adapt to these new realities, employers must develop smart hiring strategies to ensure they have the best people, skills, and expertise capable of driving change.

Additionally, to address the stark skills gap observed within the technology industry, it is crucial that employers consider upskilling their existing workforce, by identifying the gaps that stop the company from meeting its goals, and then evaluating the capabilities of its current workforce to develop job transformation roadmaps to resolve deep-seated workforce competency issues.

In-demand development and enterprise IT roles

- Software engineers

- Data engineers

- Data scientists

- AI agents

- Cloud engineers

- DevOps engineers

- Cybersecurity specialists

- IoT consultants

Manufacturing

Salary snapshot

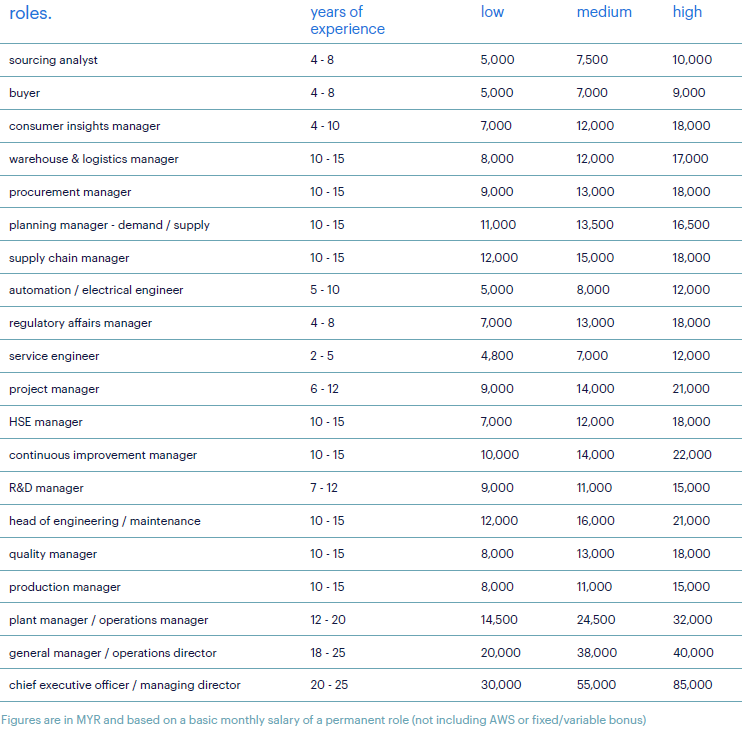

Technical

An R&D manager, who brings with them seven to 12 years of experience, could be taking home RM9,000 to RM15,000 a month. Meanwhile, a general manager/operations director with 18 to 25 years of experience could be taking home RM20,000 to RM40,000 a month; and a CEO/managing director with 20 to 25 years of experience could be earning a monthly pay of RM30,000 to RM85,000. Full list:

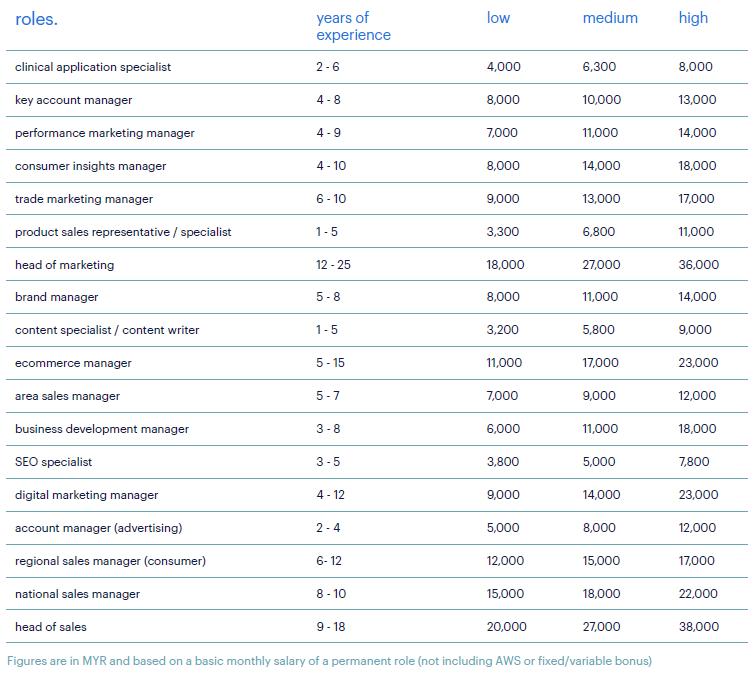

Commercial

If you are hiring an SEO specialist with three to five years of experience, you might be looking to pay them between RM3,800 to RM7,800; while a digital marketing manager with four to 12 years of experience could be looking at between RM9,000 and RM23,000 a month. At the same time, the expected pay of a content specialist/content writer who brings one to five years of experience could be RM3,200 to RM9,000 a month. Full list:

Talent trends

The Malaysian workforce still faces significant skill gaps to keep up with business requirements and technological developments. According to the report, "The national talent gap is, arguably, one of the biggest challenges that Malaysia will face in 2023. Companies in different sectors struggle to recruit and retain employees, with about 80% of employers we work with reporting talent and skills shortages as their top recruitment challenge."

To ensure a steady pipeline of skilled talent to sustain growth in Malaysia, employers can look into partnering with schools to expose students to career opportunities in manufacturing as early as possible. Internship programmes should also focus around developing unconventional technical skills among the youths.

Next, keeping in mind the labour shortage, it is time for companies to review their candidate evaluation and selection processes in securing high-potential talent. Hiring someone with good learning potential but who may not necessarily check all the boxes is better than leaving the seat empty. Hiring managers should also work with their HR colleagues to develop a comprehensive onboarding programme, to bring new hires up to speed as well as deepen their capabilities along the way.

In-demand manufacturing roles

Technical

Per the findings, there will be higher demand for talent supporting digitalisation and automation advancements of Industry 4,0:

- Automation engineers

- Service engineers

- Process engineers

- Real-time data analysts

- Data modellers

- Sourcing analysts

- Preventive maintenance managers

- Demand planning managers

- Sourcing strategists

- Sourcing specialists

- Logistics managers with Halal certification

Commercial

On the commercial front, there will be greater focus on these key digital occupations to drive business-to-consumer (B2C) engagement and growth:

- Digital marketing managers

- Digital content strategists

- SEO specialists

- Media planners

- Social media managers

Construction

Salary snapshot

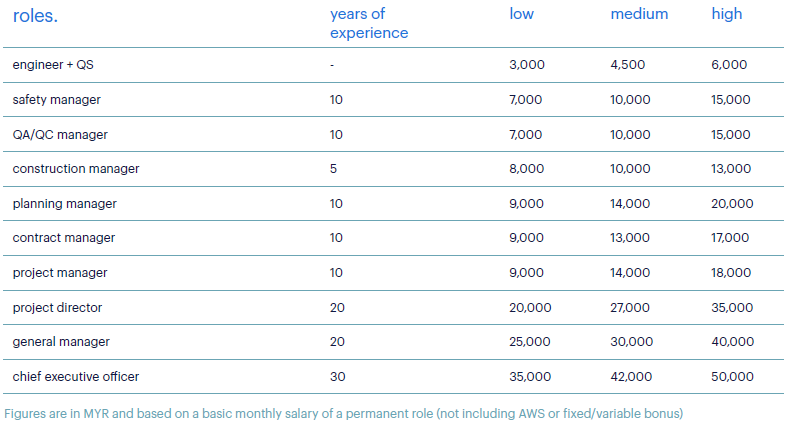

In construction, a safety manager coming with 10 years of experience could be taking home a monthly pay of between RM7,000 to RM15,000, the same range as a QA/QC manager with an equal number of years of experience.

A general manager, additionally, who comes with 20 years of experience, may take home RM25,000 to RM40,000 a month. Full list:

Talent trends

There is increasing use of the Industrialised Building System (IBS) technique and technology in the construction industry to assist in better design, fast-track development timelines, optimise resources as well as reduce errors.

To support companies’ human capital development, the Construction Industry Development Board (CIDB) Malaysia offers IBS Programmes to properly train and upskill professionals such as architects, engineers, and surveyors involved in construction projects.

While these advanced technologies automate construction processes, they do not threaten jobs since job growth would more likely offset job losses due to automation, the report pointed out. Along that line, the World Economic Forum (WEF) projects that the midpoint automation scenario will result in additional labour demand of 1.5mn net new jobs worldwide.

As a whole, a diminishing talent pool continues to plague the construction industry, and companies scramble to hire fresh talent to fulfil project obligations. The number of local graduates needs to increase to cater to Malaysia’s high demand for construction. While there were 5.61mn graduates in 2021, they were not all seeking employment in construction.

In addition, technological developments will also create new in-demand jobs that need to be integrated into the industry framework, the report added.

In-demand construction roles

- Electricians and electrical engineers

- Construction project managers

- Civil engineers

- Equipment operators

ALSO READ: Malaysia temporarily eases rules on hiring foreign workers in Q1 2023

Photo / Shutterstock

share on