share on

Malaysia ranked ninth most complex globally, while Indonesia emerged first and Thailand ranked in the middle (42nd). On the other hand, Singapore ranked 12th simplest for business globally, TMF's latest Global Business Complexity Index, released today, revealed.

Click here to jump straight to the HR and payroll findings in APAC.

Overall, of the 77 jurisdictions ranked, the top 10 most complex jurisdictions for business complexity are:

#1 Indonesia

#2 Brazil

#3 Argentina

#4 Bolivia

#5 Greece

#6 Mainland China

#7 Nicaragua

#8 Colombia

#9 Malaysia (3rd in APAC)

#10 Ecuador

On the other hand, the top 10 simplest jurisdictions worldwide are:

#1 Curaçao

#2 United States

#3 Jamaica

#4 Denmark

#5 British Virgin Islands

#6 The Netherlands

#7 El Salvador

#8 Republic of Ireland

#9 Cayman Islands

#10 Mauritius

Among countries in APAC, Singapore came in as the second simplest jurisdiction to do business in (18th globally), behind Hong Kong (12th globally). According to the report, while the consequences of the pandemic for global business rules still remain unclear, APAC governments are increasingly altering regulations and announcing new measures to support businesses, stressing an urgency for companies to stay on top of emergency legislation as it is announced.

A brief overview on Indonesia, Malaysia, Singapore, and Thailand

Paolo Tavolato, Head of Asia Pacific, TMF Group, added: "Understanding the rules of engagement with regulators is crucial, and businesses looking to operate in APAC need to constantly stay abreast of diverse and rapidly evolving legislation, integrating it fast into their policies."

In fact, the report highlighted that while regulatory frameworks in APAC had already been evolving 'at a quicker pace to become more robust for businesses', it has been accelerated by the outbreak of the COVID-19 pandemic.

Of the key APAC regulations that are rapidly shifting, the report further noted the top few that businesses should prepare for, as follows:

#1 Human resources and payroll

While COVID-19 is bringing many challenges to businesses around the globe, providing support to employees remains a high priority. APAC jurisdictions lead the way in many aspects of payroll and benefits, and this includes mandating workplace pensions, with 86% of jurisdictions legally requiring them for permanent workers. Australia and New Zealand are strong advocates of private pensions, while Southeast Asian jurisdictions, including Hong Kong and Singapore, have strong state-funded schemes.

Additionally, the region is tied with EMEA in offering the most notice period (one month) when it comes to firing practices, although it lags behind in mandatory pay increase requirements.

Apart from that, APAC governments are also moving swiftly to introduce new measures to support the economy and their populations, as well as making it easier for employers to maintain their workforce. In Singapore, over 140,000 employers have started to receive pay-outs under the government’s Jobs Support Scheme. Totaling over S$7bn, the pay-outs will help to cover the wages of over 1.9mn local employees.

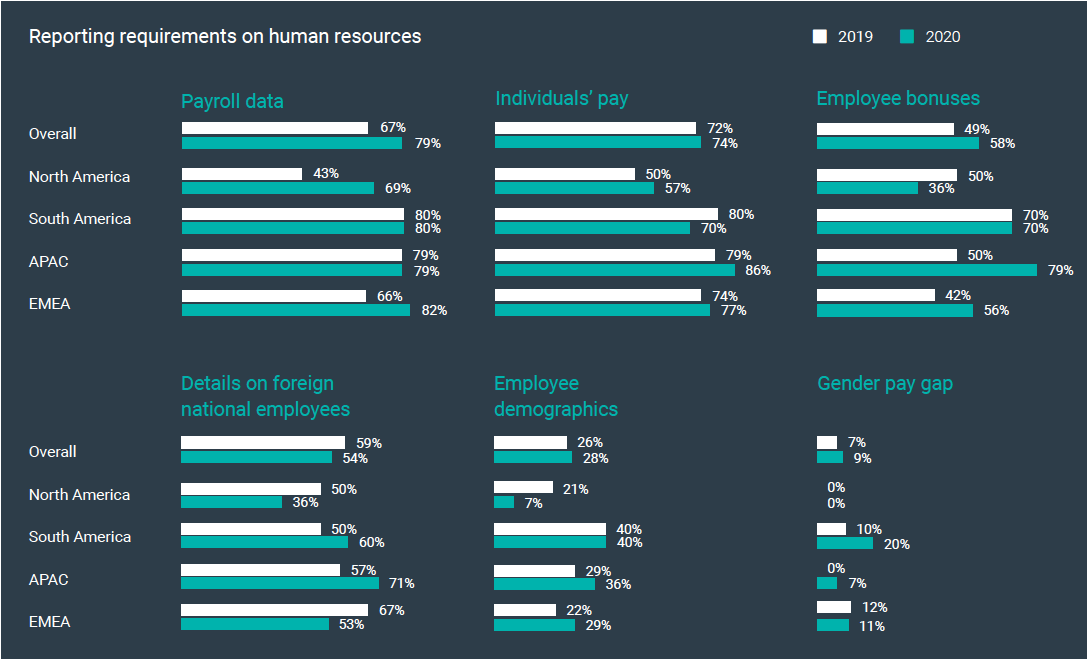

On that note, the following chart highlights the key aspects of HR and payroll across jurisdictions.

#2 Rules, regulations and penalties

In the region, 64% of jurisdictions still maintain traditional requirements that add to business complexity, such as the requirement of an official stamp to ensure legal probity. This exceeds the global average of 43%. With remote working becoming a norm, however, countries have been compelled to relook their regulations on stamps and seals.

According to the report, Hong Kong and Malaysia are becoming more modernised by removing the requirement for official chops or seals. Additionally, Singapore is considering expanding the acceptability of e-signatures for trust, property, and financial instruments.

#3 Accounting and tax

APAC jurisdictions are making a shift away from their well-known stringent auditing processes to provide relief to businesses affected by the pandemic, the report found. Further, APAC has the largest global proportion of jurisdictions (29%) making audits compulsory for all companies and is only second to South America in the proportion of jurisdictions that offer no notice period for tax audits.

However, new government schemes have allowed a variety of industries to delay compliance and reporting. For example, in Singapore, the Inland Revenue Authority of Singapore (IRAS) granted a series of automatic extensions to tax filing deadlines as well as a three-month deadline extension for Corporate Tax Payments.

Apart from that, the report also revealed APAC as the region with the second-highest proportion of jurisdictions implementing online submissions of tax invoices via an authority portal (36% versus the global average of 24%). As businesses undergo digital transformation with remote working and safe distancing measures in place, technology adoption for taxation processes in APAC will continue to accelerate.

Additionally, given how COVID-19 has battered business prospects in the short-term, governments are also recognising the importance of creating an easier environment for foreign direct investment. In fact, the number of jurisdictions in APAC that require mandatory audits has decreased in the past year, especially in countries such as India and Malaysia.

#4 Impetus towards a global business environment

Following the COVID-19 pandemic, it is likely that there will be a continued impetus towards a global business environment, with international bodies stepping up measures to coordinate and regulate trade across borders to benefit all stakeholders. An emphasis on technology and modernisation will act as the drivers to place the post-pandemic global economy back on its feet.

Thus, businesses in APAC need to be aware of and act in response to complexity in their markets, the report highlighted.

Photo / iStock

share on