share on

Unsurprisingly, three-quarters (75%) of investment professionals are feeling confident about their job security over the next 18-24 months.

In multiple research, it has been shown that investment jobs have been relatively resilient during the pandemic. A new research by The CFA Institute has further proved that. While 15% of investment professionals have had a pay cut related to COVID-19 disruption in the past year, more than half (53%) of them expected their pay reduction to last no more than a year.

Unsurprisingly, three-quarters (75%) of investment professionals are feeling confident about their job security over the next 18-24 months. The report further predicts several talent trends in the investment industry when the pandemic is over:

Hybrid model is here to stay, even for chief financial officers and traders

81% of professionals surveyed would like to work remotely at least part of the time, signalling that a hybrid-model workplace is here to stay. Those earlier in their careers, with less than two years since earning the CFA charter, are least likely to want to work remotely.

By region, interest in remote working is highest in the US and EMEA (85%) versus APAC (69%).

As for employers, they are more supportive of their workforces' desire to work remotely, with strong support for remote-work policies jumping from 15% pre-pandemic to 77% post-pandemic. This adaptability applies across roles including those who were thought to be incompatible with remote work, such as chief financial officers and traders.

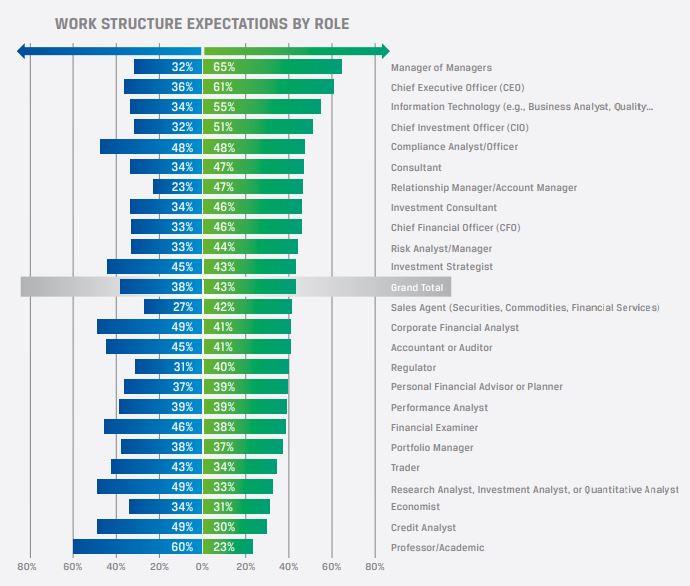

CEOs, CIOs, IT roles, and managers of managers need the most teamwork. Conversely, professors, credit and research analysts, and corporate financial analysts need the most uninterrupted time.

(Blue stands for the percentage of respondents needing 4+ hours/day for uninterrupted work; Green refers to the percentage of respondents needing 4+ hours/day for teamwork)

While a majority of investment professionals (60%) are confident in the ability of leaders to manage teams in a hybrid work environment, there is still concern that it will be more challenging for managers to be effective in a hybrid work environment than in an all-remote work experience.

Over half (53%) of the investment professionals said remote working has increased their efficiency and less than 20% said it has decreased their productivity.

The report also uncovered that leaders’ responses to the stresses of the pandemic will have lasting effects on relationships with employees.

Business travel will not be as frequent as before

As the modes of client communication will see significant changes since the pandemic, business travel is expected to be permanently reduced by 25-50%. While 39% of the respondents were travelling more than one week per month before the pandemic, only 17% of them expect to continue this pattern in the future.

Since technology plays a key role in bridging the gap between different parties, security issues are raising concerns. More than half (59%) said regulators will increase scrutiny of financial technology tools as hybrid models become more widespread. 15% expect there will be an increase in unethical activity.

Investment professionals also recognise the need for professional development to further their careers, with nearly all citing that they need to actively develop new skills, though less than half said they receive the support they need from their company in order to do so.

Better organisation culture is needed

A majority (59%) of surveyed leaders cited that their organisation culture has improved because employees have learned more about their colleagues. Meanwhile, all (100%) of the surveyed investment organisation leaders reported that mental health issues were a top concern as this relates to their employees, quickly followed by the impact of childcare and eldercare support (80%) on their staff. Comparably, only 5% cited the need to reduce the workforce as their biggest concern regarding employees' wellbeing.

Notably, half (50%) of the members have children living with them, and two-third of the respondents said that their children were still doing remote schooling in March 2021.

Investment professionals also reported a shift in what motivates them most at work, with factors such as workplace flexibility and having good team members becoming more important.

The CFA Institute's The Future of Work in Investment Management is based on two surveys: (a) an investment professionals survey with approximately 4,600 CFA Institute member respondents from 120 markets. The data were collected from March – April 2021. (b) An investment organisation leaders' survey of 41 organisations participating in the CFA Institute Experimental Partners Program, primarily located in North America, representing more than 234,000 employees. The data was collected from December 2020 – March 2021.

Photo/ Unsplash

share on

Follow us on Telegram and on Instagram @humanresourcesonline for all the latest HR and manpower news from around the region!

Related topics