Follow us on Telegram and on Instagram @humanresourcesonline for all the latest HR and manpower news from around the region!

share on

Improving cybersecurity is the top priority for leaders globally, according to Equinix's 2022 Global Tech Trends survey.

A total 85% of leaders surveyed worldwide in Equinix's 2022 Global Tech Trends survey indicated that improving cybersecurity is a top priority for their technology strategy in 2023 the coming year. Other priorities included complying with data protection regulations (84%), future-proofing the business (83%), and improving customer experience (83%) for leaders globally.

Leaders in Asia Pacific (84%) ranked 'migrating IT infrastructure to the cloud' as their second highest priority after improving cybersecurity (86%), as companies reinvent themselves in the aftermath of the global pandemic.

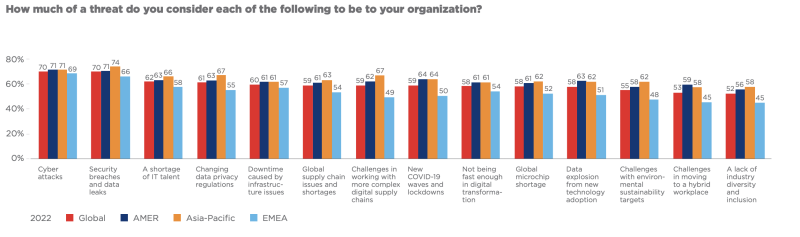

While the world navigates this period of uncertainty these priorities align with what leaders globally have identified as some of the biggest threats to the business in 2023. These include: cyber attacks (70%), security breaches and data leaks (70%), and a shortage of IT talent (62%).

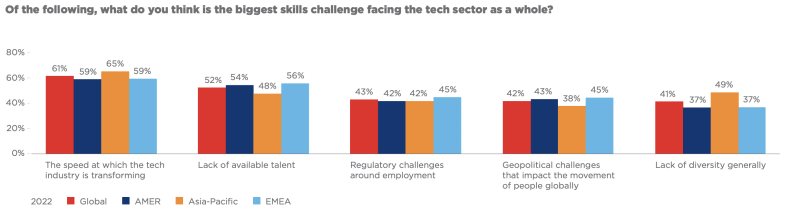

The speed at which the tech industry is transforming is creating huge opportunities and challenges in tandem. Indeed, it is cited that skills are the biggest challenge facing the tech sector as a whole, with 61% of global IT decision-makers flagging this as a concern.

When it comes to identifying the biggest challenges impacting tech skills, there are some significant variations across regions. A lack of diversity is named as a particularly prominent skills challenge in the Asia Pacific region, with AMER and EMEA respondents focusing on a lack of available talent in general.

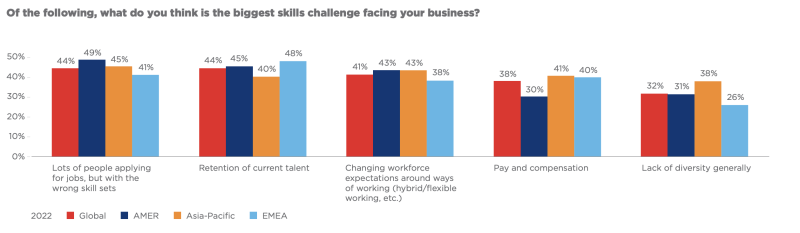

When turning their attention to the future, IT decision-makers across the globe believe the biggest skills challenges will be people with the wrong skill sets applying for jobs (44%), retention of current talent (44%), and changing expectations around ways of working (41%). EMEA respondents are most concerned about the retention of current talent (48%), with AMER and Asia-Pacific both focused on unmatched skill sets (49%/45%).

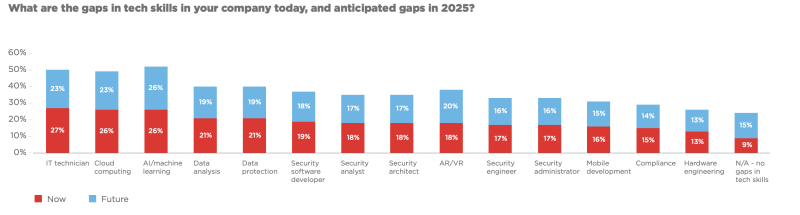

Digital leaders across the globe report the main gaps in tech skills today are in the specialties of IT technicians (27%), cloud computing (26%), and AI/machine learning (26%). Looking to the future, IT decision makers globally anticipate the main gaps in tech skills are going to remain similar to those seen today, with AI/machine learning topping the list.

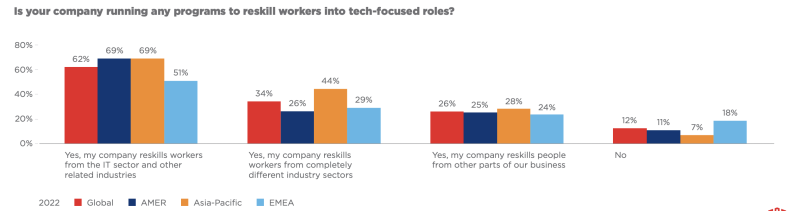

Nearly two-thirds (62%) of IT decision-makers across the globe indicated their company reskills workers from the IT sector and other related industries to tackle talent attraction challenges. But over a third (34%) are looking beyond that pool, reskilling workers from completely different industry sectors. In the Asia Pacific region, there is a significantly higher share of respondents reporting their company reskills workers from wider industry sectors (44%), while the EMEA region has the highest share of respondents indicating their business does not run reskilling programmes in support of tech-focused roles (18%).

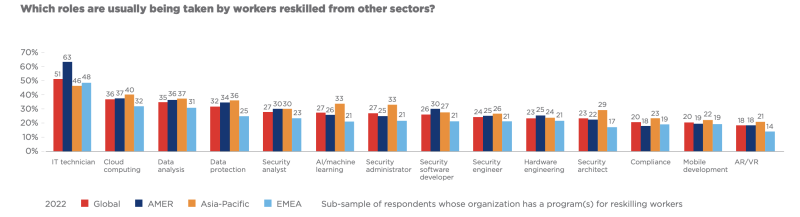

The most common roles taken up by workers reskilled from beyond the IT sector are IT technicians (51%) and team members focused on cloud computing (36%) and data analysis (35%). The AMER region reports a significantly higher percentage of IT technician roles being taken by workers reskilled from other sectors (63%). In the Asia Pacific region, there is a significantly higher share of workers reskilled from other sectors going into AI/machine learning and security administrators (both at 33%).

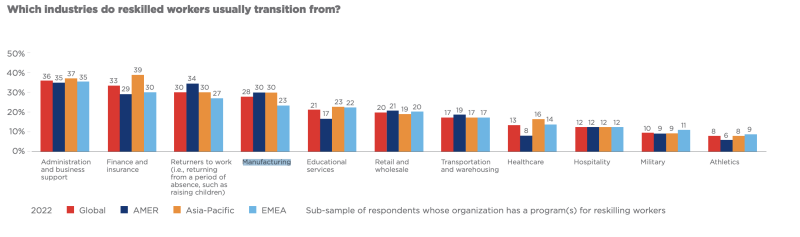

In Asia Pacific, the most common industries for reskilled workers to transfer from are finance and insurance (39%), administration and business support (37%), as well as returners to work (i.e., returning from a period of absence, such as from raising children) and manufacturing both at 30%.

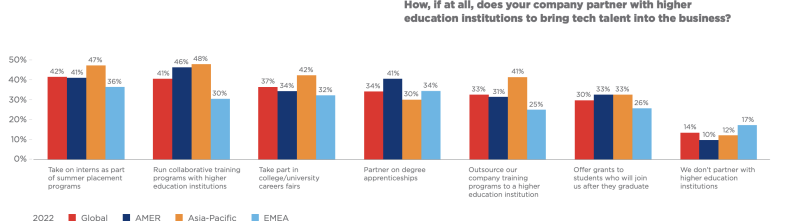

IT decision makers across the globe report their companies are partnering with higher education institutions to bring tech talent into the business, taking on interns as part of summer placement programmes (42%) and running collaborative training programmes (41%), among other initiatives.

In the AMER region, it has been found more common to partner on degree apprenticeships (41%), while in the Asia Pacific region it is more common to outsource company training programmes to a higher education institution (41%). Beyond key global trends, EMEA is focused on partnering on degree apprenticeships (34%).

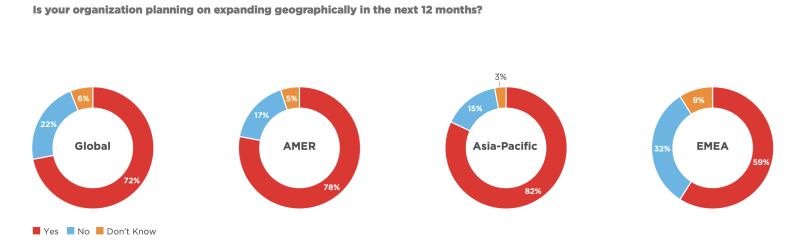

Growth remains top of mind for leaders even while they faced uncertainty and volatility in 2022, with 72% of leaders planning expansions into new cities, countries and/or regions over the next 12 months. This trend was particularly prominent in Asia Pacific with 82% of respondents indicating planned expansions, followed by those AMER (78%), and EMEA (59%) who appeared to be more cautious.

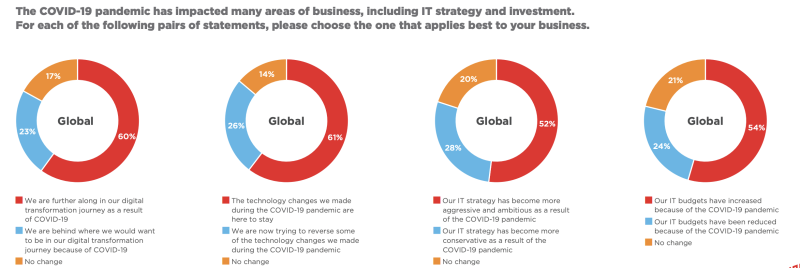

The pandemic continues to have a significant impact on digital strategies. More than half of global tech leaders (52%) say their IT strategy has become more ambitious because of the COVID-19 crisis. Six out of 10 (61%) believe technology changes and investments already made are here to stay, but a quarter (26%) admit they are now working to edit some elements implemented during lockdowns and their aftermath.

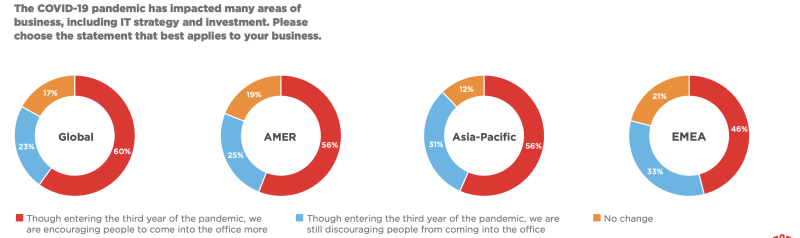

These strategies extend to talent managed remotely as well as physically in the office, according to the survey. The majority (60%) of tech leaders around the world report their companies are encouraging people to come into the office more. Respondents in AMER reported the lowest cases of discouraging people from coming back to the office (25%), while Asia Pacific (31%) and EMEA (33%) are similarly hesitant.

Lead image / Shutterstock

All in-line images / Equinix

share on