share on

At four to eight months, securities firms are set to offer the highest bonus packages to their compliance professionals in Hong Kong.

"It is now more critical than ever for HR professionals to partner closely with key business stakeholders to coordinate talent strategy and organisational focus for the future," says Benjamin Elms, Regional Director Hong Kong at Randstad, in the company's 2022 market outlook report.

The banking and financial services industry transformed significantly throughout the pandemic. In 2022, banks and financial institutions will continue to digitalise and restructure their businesses to stay agile and competitive, as well as capitalise on post-pandemic growth.

Much of the growth projection in Hong Kong’s banking and financial services industry also hinges on when border control restrictions with Mainland China and the rest of the world will be lifted.

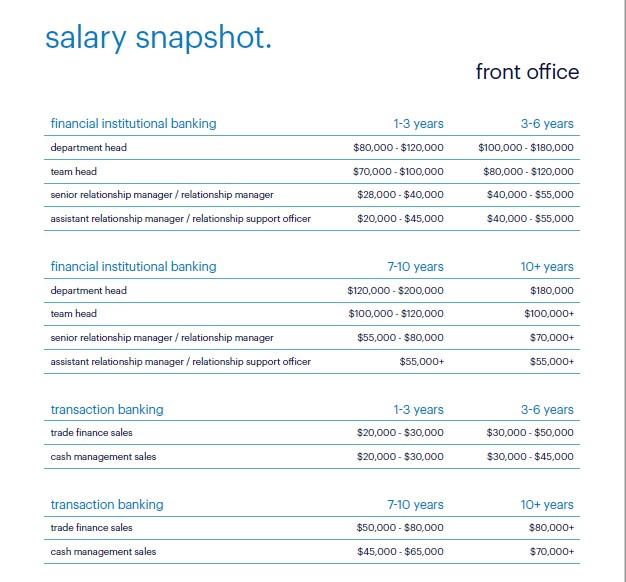

Front office roles

Corporate and institutional banking

In an effort to remain competitive in the employment market, a few international corporate and institutional banks have adjusted their bonus and salary packages to account for the market growth. Randstad anticipates seeing more corporate banks follow the trend of lifting salary and bonus freezes by the end of 2021 and match the new, post-pandemic salary rates.

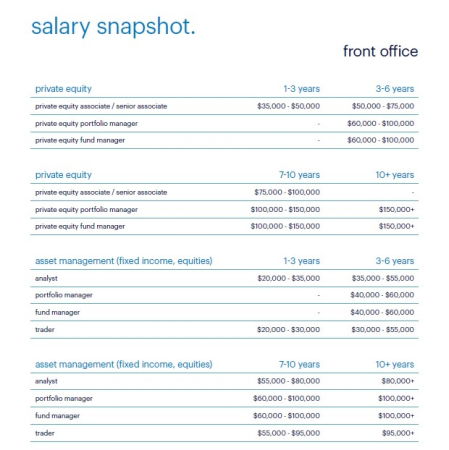

Private banking

Some big private banks are considering internal talent mobility for employees whose technical skills match these new job requirements, and they can be trained to take on client portfolio management in private banking afterwards. In 2022, the wage increase for private bankers who switch firms will be around 20% to 25%. Candidates who have excellent ties with UHNW clientele in the Greater China region could however expect an increase of 30% to 35%. Some employers may also offer a higher base salary, but they will also likely set higher KPIs for new joiners on such compensation packages.

Retail /wealth management (semi-private)

Retail and semi-private wealth management banks have less demand for talent in account serving roles, and are instead expanding their wealth management advisory teams to service the emerging HNW population in Greater China. When switching employers in 2022, relationship managers and product specialists will receive a salary increment on their base salary ranging from 15% to 25%.

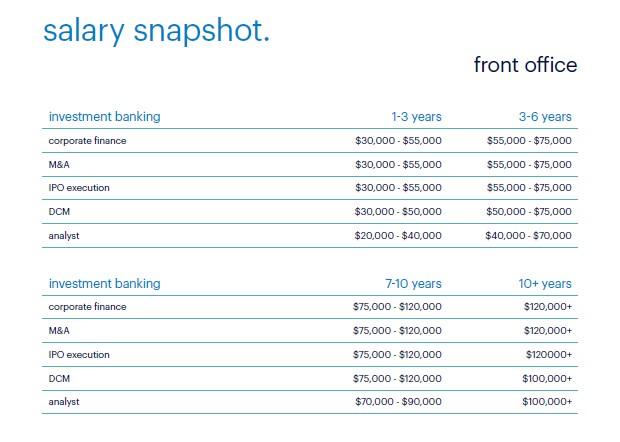

Sell-side (investment banking) and buy-side

In 2022, demand for portfolio and fund managers, trading personnel, and researchers will continue to rise on the buy-side. The need for buy-side private banking expertise has risen in tandem with the rising demand for sell-side private banking candidates. In the past, candidates tended to specialise in only one area, such as deal origination. Clients will have a growing preference for talent with diverse skill sets to handle distinct work tasks due to overlaps from both the buy and sell sides.

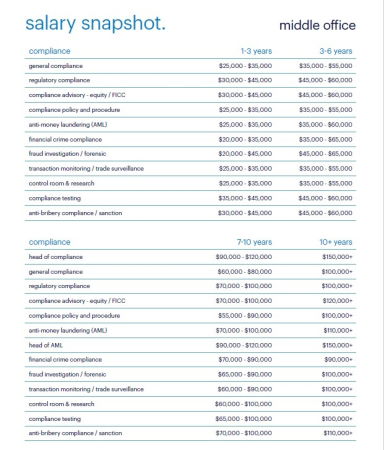

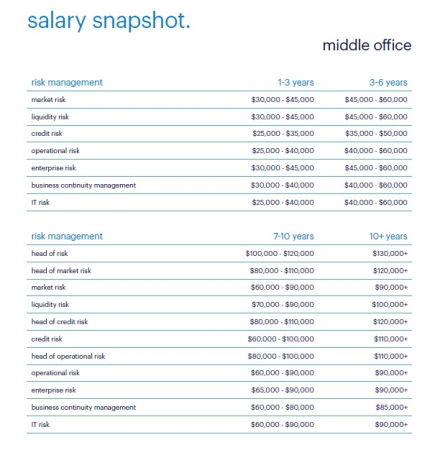

Risk and compliance

One of the most notable labour trends is the rising number of replacement roles in the risk and compliance space. Between March and September 2021, many expats departed Hong Kong for other markets, and more candidates restarted their job hunt as soon as the job market improved in 2021.

When it comes to bonuses for risk professionals in 2022, expect it to match the anticipated business demands and be higher than previous years. Candidates’ salary expectations remained unchanged and conservative at 15% to 20% for lateral moves.

When it comes to compliance candidates, expect a salary increase of 15% to 20% when switching employers. Bonus expectations vary based on the financial institution. Investment banks are expected to offer a higher bonus at three to four months, while traditional banks are offering two to three months’ bonuses. At four to eight months, securities firms are set to offer the highest bonus packages to their compliance professionals.

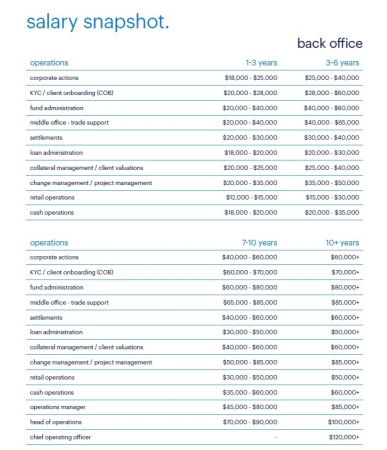

Operations

Candidates can expect to receive a 15% to 20% salary increment when switching employers. Besides salary, candidates are looking for employers that offer long-term and promising career development plans in Hong Kong to be assured of their income and job security.

Finance, accounting and audit

Internal auditors who are looking to switch employers in 2022 will likely receive a 15% to 20% wage increase. Due to skills scarcity in the labour market, those who specialise in credit risk, global markets, or treasury will be able to command 20% more. Employees who work in a foreign or local bank would be able to receive a one to two months' bonus in 2022. However, those who worked in a Chinese or Japanese investment bank may receive a bonus of up to three months.

Accounting and finance professionals who work in the banking and financial services industry can expect to receive a 15% to 18% wage increase when they change employers in 2021. The average bonus will also increase slightly from one to two months in 2021 to one and a half to two months in 2022, reflecting the market recovery in Hong Kong following the pandemic.

ALSO READ: Salary report 2022 market outlook - HR and business support

Image / 123RF

Follow us on Telegram and on Instagram @humanresourcesonline for all the latest HR and manpower news from around the region!

share on