share on

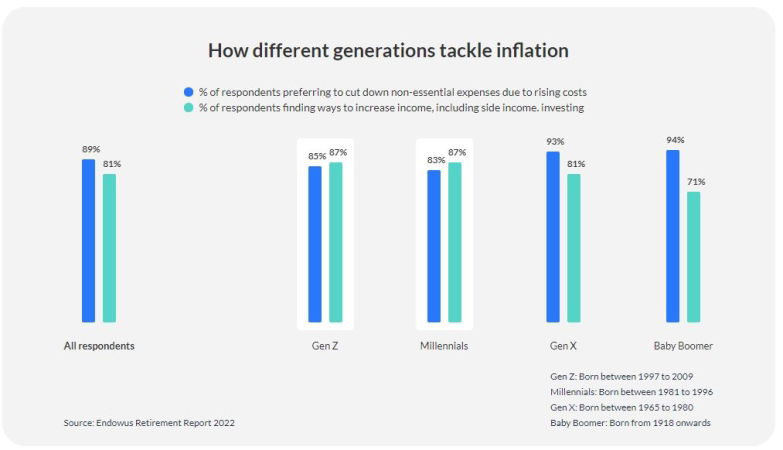

Younger survey respondents are more likely than their older counterparts to hustle for higher income (87% for Gen Zs and Millennials, vs 81% for all correspondents).

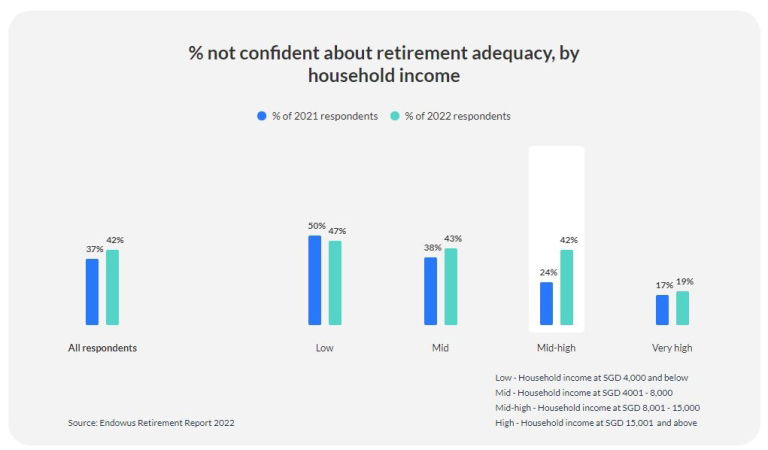

Two in five people you meet on the roads of Singapore today (42%) are likely to be concerned about saving sufficiently for their retirement, given the headline inflation rate hit a 13-year high of 7% after a decade low of 1%.

As such, Endowus sought to understand how Singaporeans' short-term budgeting, and long-term saving decisions are leading into their retirement plan. The annual Endowus Retirement Report was managed by YouGov Singapore, taking views of 1,087 Singaporean adults.

We've identified three trends from the report most likely to play into your C&B planning for this year.

1. Saving for retirement amid high inflation is a challenge most obvious for middle-incoming households

Amidst those expressing concerns about being able to save enough, the demographic with the most significant increase in respondents with retirement uncertainty is from the mid-high household income bracket (42% this year compared to 24% in 2021). According to the report, this could be because a lot of the support schemes from Budget 2022 were rolled out to especially help low to middle-income families.

For the purpose of this report, this is how household income (per month) was classified):

- Low - Household income at SG$4,000 and below

- Mid - Household income at SG$4001 - 8,000

- Mid-high - Household income at SG$8,001 - 15,000

- High - Household income at SG$15,001 and above

[All currencies in this article are in Singapore dollars, or SG$.]

As such, findings identified that private transport and holiday expenses, which are considered luxury spending more often consumed by mid-high income Singaporeans, have risen significantly at 24.1% and 8.1%, respectively.

On the positive side, the report highlighted a number of tax-relief schemes for mid-income locals to pursue, for example, cash top-up and CPF transfers under the Retirement Sum Topping Up Scheme is one option, where Singaporeans can get maximum tax relief of $8,000 for their own CPF account.

Another great, and less known, option is the Supplementary Retirement Scheme top-ups (maximum tax relief of $15,300), which can help save on income tax expenses. Single-income households with a monthly income of $15,000 can save up to $4,095 by leveraging CPF and SRS top-up tax savings.

More households have already jumped on the bandwagon to same more via CPF. CPF top-ups in the first nine months of 2022 hit a record of more than $3.5bn. Meanwhile, SRS contributions topped $2bn in 2021 to reach over $14bn in total, doubling in the five years prior.

2. The generations are tackling inflation in different ways - Gen X is most likely to cut non-essential expenses

A deeper look into the lifestyle choices across Singapore's different demographics shows that younger survey respondents are more likely than their older counterparts to hustle for higher income (87% for Gen Zs and Millennials, vs 81% for all correspondents). But they are also less likely to cut down on non-essential spends (85%, 83% for Gen Zs and Millennials respectively, vs 89% for all correspondents).

Given that the majority of young Singaporeans are at the early stages of their career, the trend of young job-hoppers fighting for a more attractive pay package is consistent with this finding, per the researchers.

However, young Singaporeans should be wary of lifestyle creep. Based on the survey, Singaporeans (70%) across all generations are less likely to prefer to downsize or delay bigger financial goals. Young professionals with aspirational big-ticket spending have to be wary of even higher inflation with luxury spending: private property and car prices increased by 9.3% and 14.4% in 2021.

With rising interest rates, cooling property measures, and a looming recession, there are risks that Singaporeans should take into account before committing to long-term, big financial spending.

3. Millennials are less likely to rely on CPF payouts for retirement

Given the harsh economic environment, Millennials are most likely to have their own financial plans (67%) and less likely (40%) to rely on CPF payouts. Gen X and Baby Boomers are not too far behind, with 65% and 62% of respondents respectively saying that they have looked at personal financial plans over and above CPF payouts.

In terms of the reliance on CPF payouts for retirement, Gen X is the most keen to continue doing so, cited by the most among the generations at 53%, followed by Baby Boomers at 49%.

Samuel Rhee, Chairman and Chief Investment Officer, Endowus, explained: "A sustained increase in the long-term trend inflation from 1% to 3% will lead to a 45.8% decrease in retirement savings over 30 years. A 1% annual inflation rate will reduce purchasing power by 26% over 30 years whereas a 3% rate will reduce it by almost 60%.

"This cost escalation and declining purchasing power makes it even more important for Singaporeans to not only set aside enough money for retirement but to also grow it meaningfully through investments."

In-line graphics / Endowus

Lead image / Shutterstock

Follow us on Telegram and on Instagram @humanresourcesonline for all the latest HR and manpower news from around the region!

share on

Follow us on Telegram and on Instagram @humanresourcesonline for all the latest HR and manpower news from around the region!

Related topics