Follow us on Telegram and on Instagram @humanresourcesonline for all the latest HR and manpower news from around the region!

share on

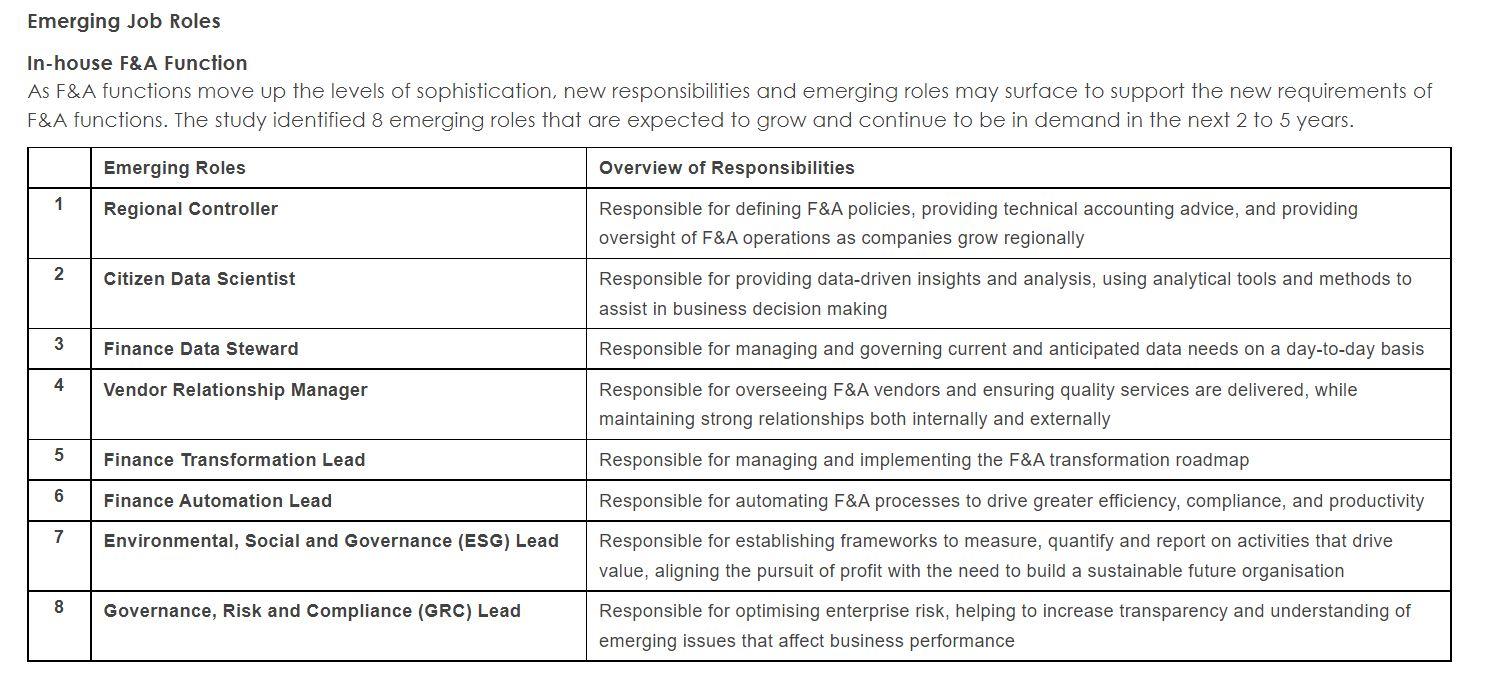

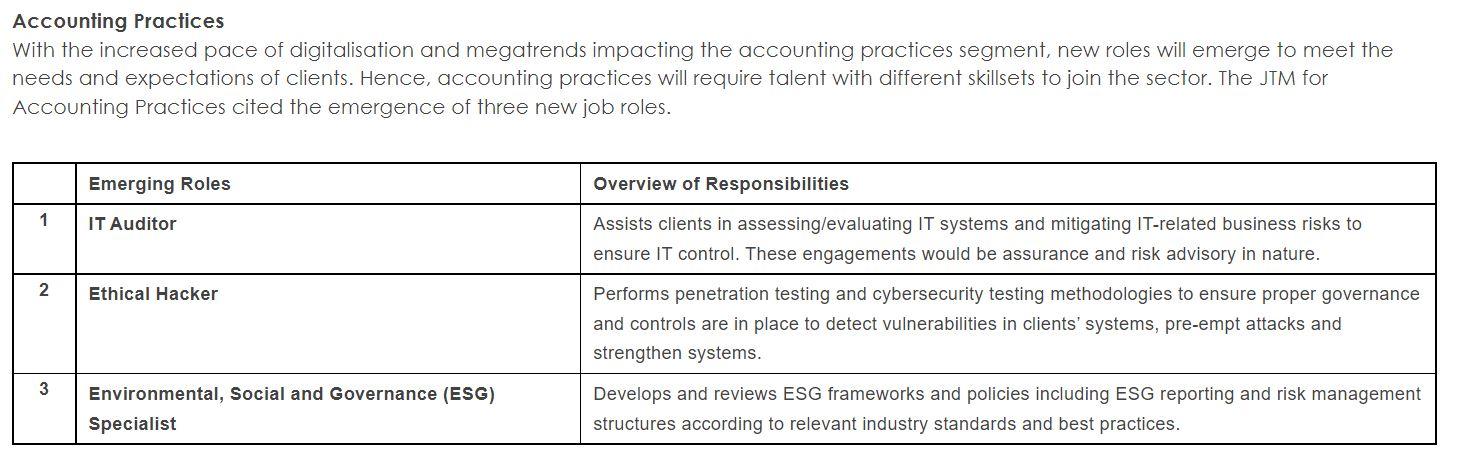

The Maps have identified key roles that will be at risk over the coming years, as well as eight emerging job roles in finance & accounting, and three in accounting practices.

The Jobs Transformation Maps (JTMs) for In-house Finance & Accounting (F&A) functions and Accounting Practices were launched on 5 January 2022 (Wednesday).

A partnership between the Singapore Accountancy Commission (SAC), the Singapore Economic Development Board (EDB), Workforce Singapore (WSG), and SkillsFuture Singapore (SSG), these maps have been developed to explore key technologies driving change, evolving and emerging job roles, and requisite skills, amongst other topics.

Details on the Maps and their components are as follows:

JTM for In-house Finance & Accounting (F&A) functions

The JTM has identified the following megatrends reshaping F&A functions:

1. Dynamic business requirements are increasing demand for data-driven F&A work

The use of data, analytical skills, and the latest technology will help F&A functions gain more predictive insights to support businesses in a volatile environment. Amongst global trade volatility and tension, commodity price fluctuations, and digital disruptions, more organisations are making changes in response. Many were expanding into new markets and retreating from others, finding new go-to-market and sales channels, and optimising distribution processes and supply chains. F&A functions are playing an active role in anticipating, developing and analysing financial scenarios to predict the impacts of changes on the organisation.

As such, F&A functions need to assess large volumes of data and develop appropriate data governance strategies, before employing advanced analytical tools and techniques to support more accurate data-driven decisions.

2. Digital disruption is accelerating the need to transform F&A to remain competitive and stay relevant

The rapid digitalisation of the 21st, century spurred by automation, advanced analytics, and cognitive and artificial intelligence (AI) applications, will continue to disrupt F&A functions. The pace of digital disruption is further expected to increase, particularly due to many new applications and less costly and easier implementation.

F&A functions need to embrace technology and digital skills to transform and improve their capabilities and adapt to changes in business.

3. Greater regulatory oversight and focus on sustainability are creating new F&A reporting and compliance requirements

The compliance environment is seeing an increasing amount of complexities. F&A functions need to understand these changes and appreciate the impacts on business.

4. F&A operating models are shifting to optimise resource allocation and service delivery

To scale up higher-value activities and maximise available resources, F&A functions can further adopt Centres of Excellence (CoEs) in various F&A processes.

The JTM further examined how 20 F&A job roles will be impacted. It was noted that 16 out of 20 F&A job roles will experience varying impact levels in the next two to five years, while the remaining four out of 20 roles are at risk of displacement. The 16 job roles are not susceptible to displacement due to automation, "as they are likely to perform more value-adding tasks".

As for those at risk, junior FA and MA roles are particularly affected as new technologies are used to automate high-volume, repetitive and manual tasks.

With all the changes, the JTM also revealed eight emerging F&A job roles, including finance transformation lead, environmental, social, and governance (ESG) lead, and citizen data scientist.

JTM for Accounting Practices

The JTM for Accounting Practices observed four key drivers impacting the accounting practices sector.

Intelligent automation will automate transactional and repetitive job tasks (e.g performing bank confirmations and casting of financial statements). This will therefore shift the nature of work performed from transactional and repetitive tasks to advisory and complex tasks, resulting in increased attractiveness for talent. Practitioners need to learn new skills to adapt to evolving tasks.

Cloud computing will increase productivity by streamlining information sharing and facilitating collaboration amongst teams in a world of remote and hybrid work arrangements. With cloud computing, it is necessary to implement processes a to safeguard information and mitigate potential risks. As such, practitioners are presented with opportunities to learn new skills such as cloud integration and cybersecurity knowledge.

With Changing public/client expectations, practitioners are expected to bring greater value by providing insights, driving process improvements, and developing business solutions. For example, there has been a recent demand for practitioners to play a more pre-emptive role in detecting potential issues, especially in tax and financial forensics.

Workforce challenges are emerging across all functional tracks - although particularly so for assurance, tax, financial accounting, and corporate secretarial.

The JTM also examined 38 different job roles, the majority of which will experience a medium degree of change in job tasks and require moderate job redesign due to being augmented by technology. For example, a business valuation senior will leverage AI & analytics to support the development of financial models but practitioners will still need to review the preliminary outputs of the model.

Three emerging roles were also identified: IT auditors, ethical hackers, and environmental, social and governance (ESG) specialists.

In a Facebook post on the launch of the JTMs, Minister for Manpower Tan See Leng commented: "To excel in today’s increasingly complex business and regulatory environment, workers in these sectors will do more than crunching numbers."

He added: "We can look forward to a range of other initiatives that will be launched progressively to support transformation and upskilling of the sector."

Accountancy Job Redesign for Accounting Practices and Finance & Accounting functions

On the same day, WSG, SAC, and the Singapore National Employers Federation (SNEF) concurrently launched the Accountancy Job Redesign Initiative and Toolkit, which aims to enhance the roles of F&A professionals and improve the productivity of F&A functions by leveraging on technology.

The initiative will act as a step-by-step guide to redesign the top four job roles impacted by technology as cited by the JTMs. Currently, the toolkit features two job roles — Accounts Executive, and Senior Accounts Executive/Accountant. It will be available for the remaining two roles, Tax Associate and Audit Associate, in late Q1 2022, and will include a job evolution and training roadmap, change management strategies, case studies, and available funding options for job redesign and adoption of technology solutions.

Through this initiative, enterprises with in-house F&A functions, as well as Accounting Practices, will be able to review accounting work processes to streamline transactional or repetitive tasks and improve productivity, increase job value and attractiveness through job enrichment or enlargement, and/or implement accounting technology solution(s).

Eligible enterprises will also be able to receive funding support through the Productivity Solutions Grant for Job Redesign (PSG-JR) at up to 80% of the job redesign consultancy cost, capped at S$30,000 per enterprise, till 31 March 2022. Beyond 31 March 2022, the PSG-JR funding rate will revert to up to 70% of the job redesign consultancy cost, capped at S$30,000 per enterprise. This initiative, it was shared, is targetting to benefit at least 50 companies and over 150 professionals for a start.

Lead image / 123RF

Tables & infographics / Provided

share on