share on

Jump to an exclusive from Jason Ho, Head, Group Human Resources, OCBC Bank, on how the bank helped to ease employees’ worries and support them through this period.

With the virus hitting many economies across the globe, many Singaporeans are worried about losing their jobs despite extensive government support. This was revealed in the OCBC Financial Impact Survey for COVID-19 released today.

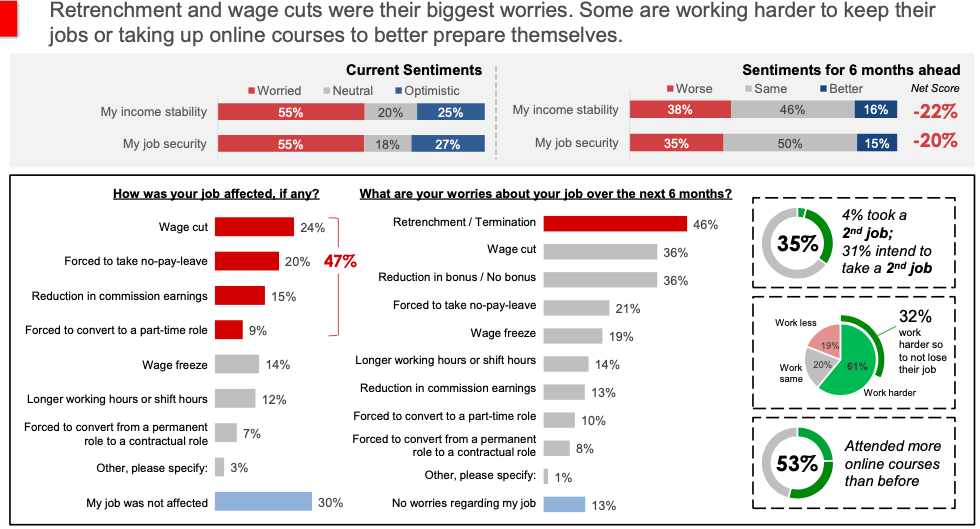

To measure the financial impact on Singaporeans during the global pandemic, in mid-May, OCBC surveyed 1,000 Singaporean and PR working adults between the ages of 21 and 65 across different income levels. It revealed that despite government support measures such as the Jobs Support Scheme, 46% of those surveyed are worried about losing their jobs.

A similar proportion (47%) have experienced a dip in income, such as through wage cuts, being forced to take no-pay leave or a reduction in commission earnings.

To keep their jobs and remain relevant for a post-COVID-19 world, Singaporeans are working harder than before and attending more online courses.

About half (53%) are attending more online courses than before, and 61% are working harder than before the virus hit with more than half of them doing so to keep their jobs. To make up for the dip in income as firms implement wage cuts and no-pay leave, 35% indicated that they intend to take or have taken on a second job.

Among the age groups, those in their twenties stood out for their optimism and hustle. For example, 64% of this group said they were taking up more online courses, compared to an average of 53% across all the age groups.

In an exclusive statement to HRO, Jason Ho, Head, Group Human Resources, OCBC Bank, shared how the bank helped to ease employees’ worries and support them through this period:

Singaporeans are understandably worried over the past few months with the COVID-19 outbreak. Initially, we were worried about our personal safety and health, but now, we are also worried about the impact it has on the global economy and our jobs.

Since the onset of the outbreak, our immediate priority was to safeguard the health and well-being of our employees even as we remain committed to serving our customers. We put in place safe management measures such as staggered working hours, safe distancing, spilt operations and temperature screening; and we continued to monitor the situation and adapted our plan accordingly.

For our people, we assured each of them very early on that we do not plan to have any retrenchment arising from this outbreak because they are not just an employee. Each of them has a family that we consider as part of our extended family. We have held on to this commitment and have not let go of any staff due to the outbreak.

We introduced HR care packages in different countries to ensure enhanced care and support are given to each and every one of our employees, depending on the local needs. On 17 March 2020, we launched the COVID-19 Care Package for our employees in Singapore, providing access to tele-health, financial support and private transportation when needed. On top of that, we also provided transport subsidies to employees who are required to return to office during the Circuit Breaker period in the form of vouchers which can be used for transport or food.

Our extensive investment in technology and digital capabilities over the years has enabled the roll-out of a wide range of our digital solutions for our customers and employees. This has come in very handy during these challenging times. With many of our employees working from home during this COVID-19 pandemic, it is important to keep them actively engaged not just in work but also in their physical, emotional and mental wellness.

Our managers and leaders have also reached out to engage their staff. There is no lack of creativity on how they do so. Some continue to lunch with colleagues, albeit virtually. Others hold friendly competitions for best new circuit breaker hobbies or best work from home stories. We also rolled out virtual COVID-19 specific courses online to address the physical, mental and emotional wellbeing as well as leadership. These are part of the Bank’s Future Smart Future Workforce Learning Festival – a six-month long virtual festival which aims to foster wellness of our employees. We will continue to invest even more in technology and in our people.

As we approach the end of COVID-19 circuit breaker, we are taking a phased approach to allow re-adjustment to working in the new office environment as well as to respond to any changing external environmental risk. We are also looking at reconfiguring our workspace to ensure a safe working environment for our staff. We will continue to monitor the situation and adapt our plan accordingly to safeguard the safety of our employees while ensuring that we are able to serve our customers adequately.

The survey also highlighted five key gaps in Singaporeans’ financial planning and knowledge during this crisis.

- Reducing investments

Among those who have invested, one in two (54%) are worried about their portfolio, with 40% saying they intend to reduce their investments. 16% said they will reduce by more than 20%. - Stopping or reducing funds for retirement

27% of those with financial plans said they have stopped setting aside or even reduced their funds for retirement. A third (32%) of the sandwiched generation - those between the ages of 40 and 54 and many of whom must take care of both young children and ageing parents – said they have cut down on such funds. In stark contrast, 23% of those in their 20s with a retirement plan have put aside more money for this goal during this time of uncertainty. - Reducing their savings

55% of those surveyed said they have reduced their savings with 22% saying the reduction is more than 20%. - Not having enough emergency savings

Only 30% can sustain themselves for more than 6 months if they were to lose their job now. 18% of them have enough savings to cover only up to one month of expenses. - Not having enough insurance

41% are worried if they have enough insurance coverage with 47% of Singaporeans aged between 40 and 54 the most concerned.

Tan Siew Lee, OCBC Bank’s Head of Wealth Management Singapore, said: “It is encouraging that some are doing the right thing to boost their financial health, by continuing to save, spending prudently and making sound investments according to their risk appetite and financial circumstances. But we also hope that those who are cutting back on these aspects, which are crucial to building a nest egg for retirement, will not despair.”

Koh Ching Ching, OCBC Bank's Head of Group Brand and Communications, added: “The COVID-19 outbreak has caused unprecedented economic impact on many people. Yet, like past crises, the current one will eventually go away. Crisis or not, good financial discipline and planning are important as they have long-lasting impact.”

To help narrow the gaps in financial planning and understanding in a crisis, OCBC Bank has launched a series of videos featuring its employees, who share their experience going through previous crises, and its Wealth and Human Resource experts, who provide tips on how to make the most out of the current one.

Photo / iStock

If you're an HR/L&D leader who'd like to be interviewed for our upcoming L&D series, on the coolest learning campaigns, the biggest changes to your L&D strategy, and more, please write to us at jerenea@humanresourcesonline.net

share on

Follow us on Telegram and on Instagram @humanresourcesonline for all the latest HR and manpower news from around the region!

Related topics