share on

At a glance, the progressive wage credit scheme (PWCS) support will be increased, and the jobs growth incentive (JGI) will be extended until March 2023.

In light of global inflation, Singapore's Ministry of Finance, on 21 June 2022 (Tuesday), announced a S$1.5bn support package to provide targeted relief for businesses, workers, as well as households. The package will be funded from the "better-than-expected" fiscal outturn in FY2021, and makes no further draw on the nation's past reserves.

This article focuses on the first two aspects of the support package (i.e. businesses and workers).

The support package is expected to extend more help for local companies in their enterprise and workforce transformation. A spokesperson said: "We recognise that some businesses face higher operating costs in the near term, and may need additional support. We will therefore do more to support businesses and workers through this transition".

Businesses

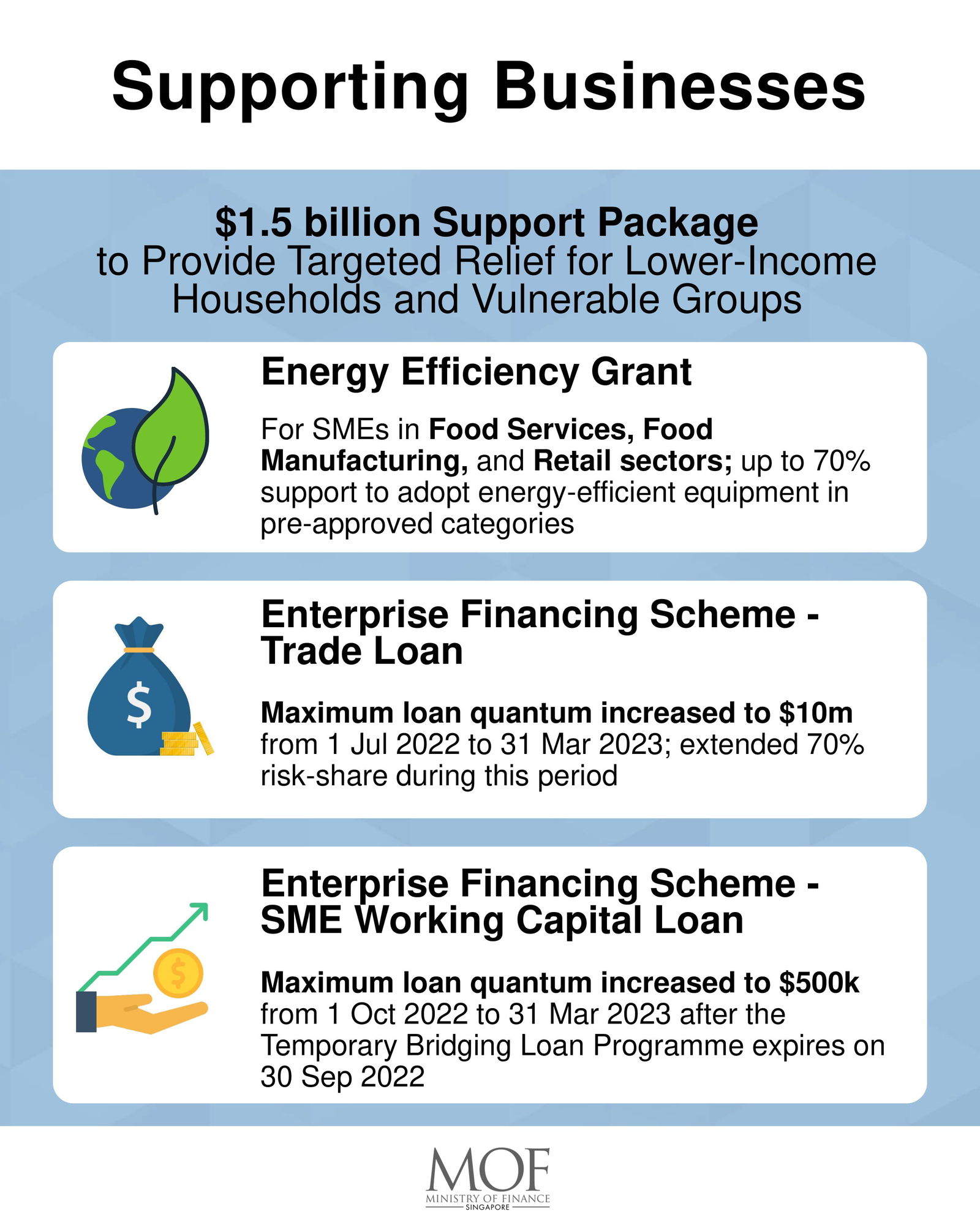

Regarding businesses in Singapore, there are three areas in the support package to note.

First, there will be a one-month foreign worker levy waiver for Singapore’s 11 chicken slaughterhouses to support firms affected by the chicken export ban.

Second, there will be a energy efficiency grant for local SMEs in the food services, food manufacturing, and retail sectors with up to 70% support to adopt energy-efficient equipment in pre-approved categories.

Finally, there will be two enterprise financing schemes. For one, the trade loan’s maximum loan quantum will be increased to S$10mn from 1 July 2022 to 31 March 2023, with an extended 70% risk-share during the period. For the other, the SME working capital loan’s maximum loan quantum will be increased to S$500,000 from 1 October 2022 to 31 March 2023, after the temporary bridging loan programme expires on 30 September 2022.

Businesses & workers

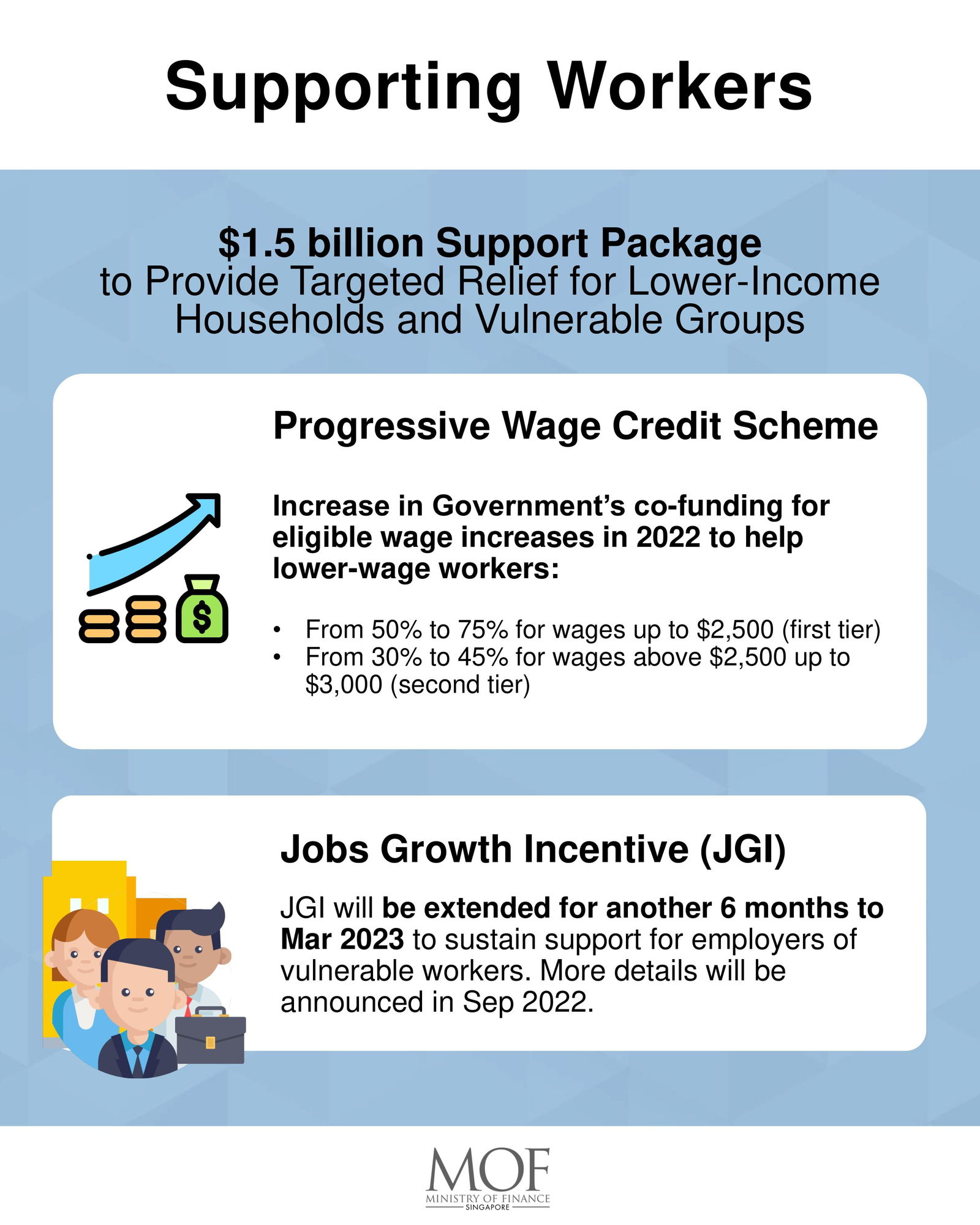

Supporting both businesses and workers, the Government’s co-funding share for 2022 progressive wage credit scheme (PWCS) support will be increased from 50% to 75% for wages up to S$2,500 (first tier), and from 30% to 45% for wages above S$2,500 up to S$3,000 (second tier). Employers should be aware that all other existing scheme parameters remain unchanged.

In addition, businesses can continue to benefit from the current jobs growth incentive (JGI) till September 2022, when they hire mature jobseekers who have not been working for at least six months, as well as persons with disabilities or ex-offenders. That said, the JGI will be extended for another six months to March 2023 to "sustain support for employers of vulnerable workers".

"The Ministry of Manpower (MOM) will provide more details of the JGI extension closer to its expiry," the spokesperson said.

Workers

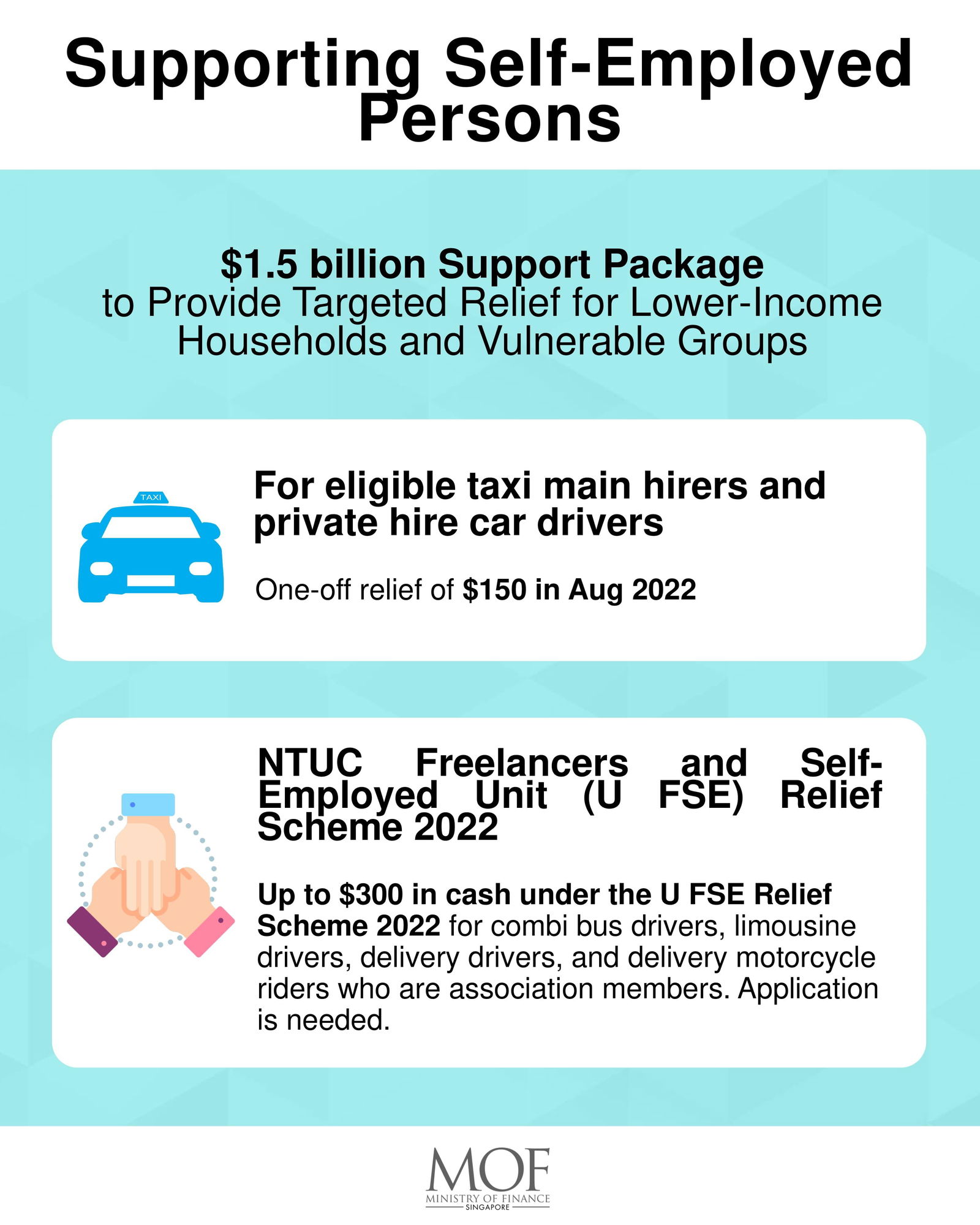

As for workers only, specifically self-employed persons, there will be a one-off relief of S$150 for eligible taxi main hirers and private hire car drivers in August 2022.

On top of that, up to S$300 in cash will be made available under the National Trades Union Congress's (NTUC) freelancers and self-employed unit (U FSE) relief scheme for combi bus drivers, limousine drivers, delivery drivers, and delivery motorcycle riders who are association members.

Beneficiaries are to note, however, an application is needed to receive the aforementioned financial assistance. More details on this will be provided by August 2022.

Also read: Singapore's Public Service Division to pay all civil servants a mid-year AVC of 0.35 month

Images / MOF

Follow us on Telegram and on Instagram @humanresourcesonline for all the latest HR and manpower news from around the region!

share on