share on

The demand for talent in this sector is expected to intensify, as the majority of fintech companies (72%) expect sectoral growth in this year.

Singapore is still one of the leaders of fintech in Asia and the world, despite a tumultuous year for the industry in 2022. The macroeconomic outlook remains volatile as the industry experiences the impact of inflation, rising interest rates, geopolitical tension, and threats of an economic slowdown.

Singapore’s competitiveness in the world economy, market stability, and strong regulatory backing however, have allowed it to weather this storm.

According to the Global Financial Centres Index 32 report, Singapore ranked third in the world overall index as global financial centre behind New York, London, and surpassing Hong Kong to take the lead in the Asia Pacific region.

But with opportunities come challenges and the COVID-19 pandemic has put the spotlight on the talent agenda in the fintech industry in Singapore, re-shaping the expectations between employees and employers.

The fourth edition of the Fintech Talent Report by Singapore FinTech Association (SFA) and Accenture Singapore evidenced the nation's attractiveness as a fintech hub, with 84% of respondents surveyed indicating their headquarters are in Singapore.

For the survey, links were sent to 1,637 fintech leaders in Singapore, returning 122 valid responses, which includes 12 responses that come from six businesses with multiple co-founders. Inputs from interviews with fintech executives and HR representatives, as well as social media & news scanning were also considered.

For fintech leaders to continue driving business growth, it is imperative to prioritise the talent agenda, as a thriving and skilled workforce is critical to enabling a sustainable and future-ready organisation. Companies will need to solidify their commitment across different stages of the talent lifecycle – to continuously attract, develop, and retain the best talent in Singapore.

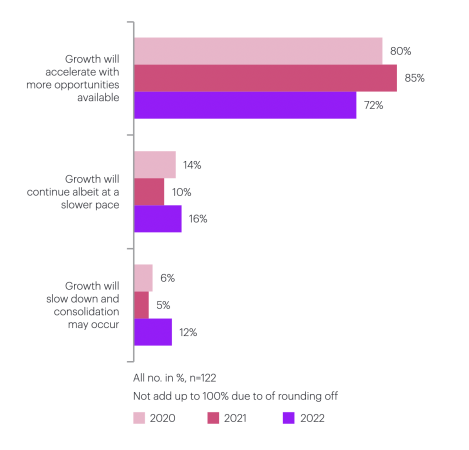

Growth in the fintech sector is expected to intensify the demand for talent. According to the survey, a majority of fintech companies (72%) surveyed expect that sectoral growth will continue, accelerating with more opportunities available. Albeit this number was less than in 2021 where 85% of respondents said the same.

As a result, the majority of (95%) fintech companies says the survey expect an increase in their workforce over the next one-two years as compared to 2021 (84%). With an estimated 14,000 employees in the Singapore fintech industry, the workforce is projected to grow at an average of 45%, translating to an increase of 6,000 headcount over the next two years.

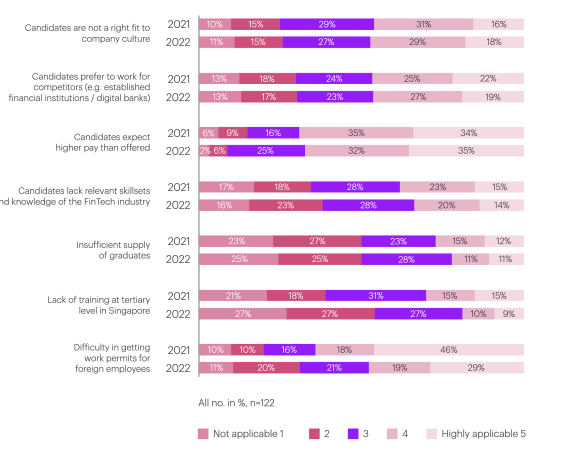

With a relatively small pool of talent available in Singapore, the demand for fintech talent continues to outpace local supply and is further intensified by several factors, such as:

- ‘candidates expect higher pay than offered’ (67%),

- ‘difficulty in getting work permits for foreign employees’ (48%),

- ‘candidates not being a right fit for to company culture’ (47%), and

- ‘candidates prefer to work for competitors’ (46%).

When asked about suggestions to address the talent gap, ‘making it easier for foreign employees to obtain work permits’ (57%) and ‘establishing more partnerships within the broader ecosystem’ (55%) were voted as the top two solutions. Meanwhile, ‘offering higher salary packages’ (38%) was the ranked as the least effective option, indicating that it is not a sustainable long-term solution for fintechs to close the talent gap.

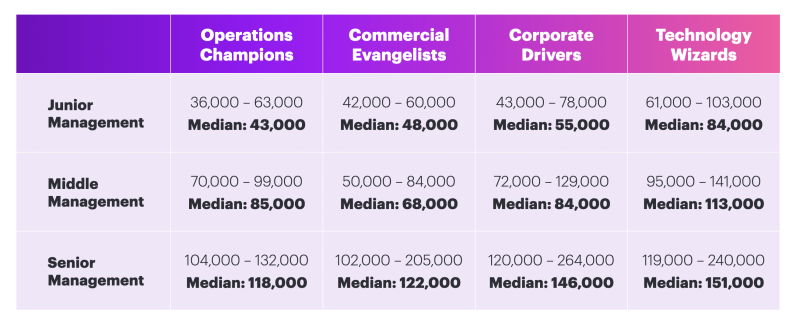

However, companies might not have a choice as a tight labour market has made it more difficult to secure talent. Fintech companies are not just competing with financial institutions (FIs) on technology-skilled talents, but across other industries as well. Those in a senior management roles can make a median annual salary of over S$100,000.

According to the survey results, employee referrals (90%), online job portals (81%), and headhunters and employment agencies (52%) are the top three channels used by fintechs to source talent. However with such high demand, fintechs are adapting their hiring strategy and investing in alternative ways of sourcing for talent such as partnerships with other organisations, tapping into gig marketplaces, and investing in young talent via campus recruitment and internship programmes.

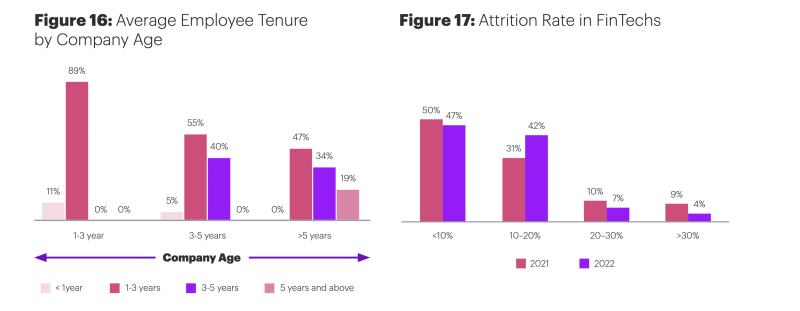

Attrition rates however, are at an all-time high and more than half of the fintech companies in the report indicated an average employee tenure of less than three years. While potential candidates look to join fintechs for opportunities to develop and enhance their careers, they leave for the same reasons, indicating that they may not be getting the continued growth that they desire.

On average, 53% of survey respondents have indicated attrition rates of 10% or greater, a slight increase as compared to the results in 2021. This indicates that attrition rate has gone up in the past year, which is supported by how 42% of companies have experienced an attrition rate of between 10-20% this year, an 11% increase as compared to 31% in 2021.

According to the survey results, 50% of fintechs spend less than $500 on learning and development per employee, as compared to 28% in 2021. In addition, the most common mediums of learning and development are on-the-job-training, coaching and mentoring, and formal training (in-house).

However, there seems to be a lack of awareness are national grants available to fintech companies in Singapore. According to the survey results, the majority (88%) of companies have not leveraged Institute of Banking and Finance (IBF) funding to send employees on upskilling courses in the past 12 months, primarily due to lack of awareness (87%).

While the pandemic has seen fintechs increasing the adoption of flexible work arrangements and becoming more aware of mental health, they are only scraping the surface when it comes to building a truly human workforce. There is an opportunity here for fintechs to expand their definition of holistic employee wellbeing to include the full range of employee needs.

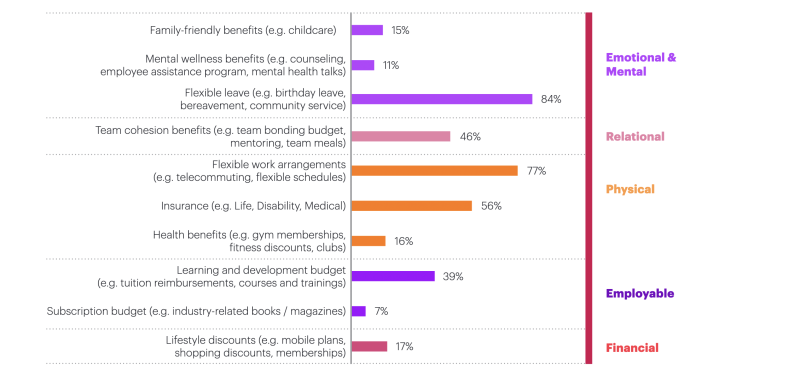

The top three employee benefits offered by most fintechs are flexible leave (84%), flexible work arrangements (77%), and insurance (56%). However, only a minority of fintechs surveyed offer family-friendly benefits (15%), mental wellness benefits (11%), and subscription budgets (7%).

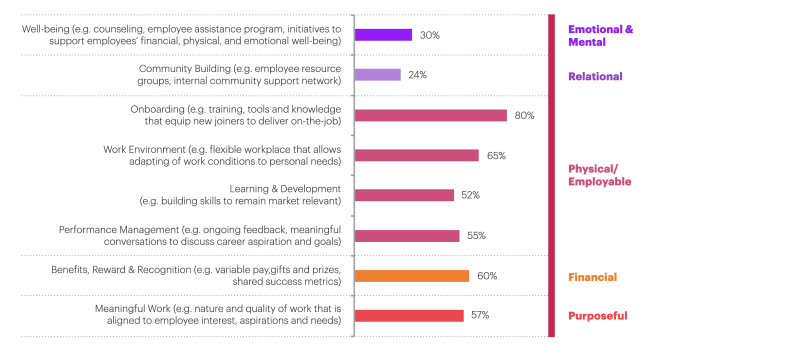

When asked about the practices fintechs use for employee engagement, the top three practices were onboarding (80%), flexible work environment (65%) and benefits, rewards and recognitions (60%). Meanwhile, the least used practices were wellbeing (30%), and community building (24%) practices.

Talent and skills shortages continues to be the single biggest threat ahead of inflation and cybersecurity issues. Organisations are going through profound change on compressed timelines and traditional ways of working need to evolve. This is placing new demands on the workforce at a time where people are fundamentally re-evaluating their relationship with work.

Images / Fintech Talent Report 2022 (citing the top in-demand roles in the fintech sector)

share on