share on

Chicago, Boston, and Seoul entered the top 10, replacing Paris, Shenzhen, and Beijing.

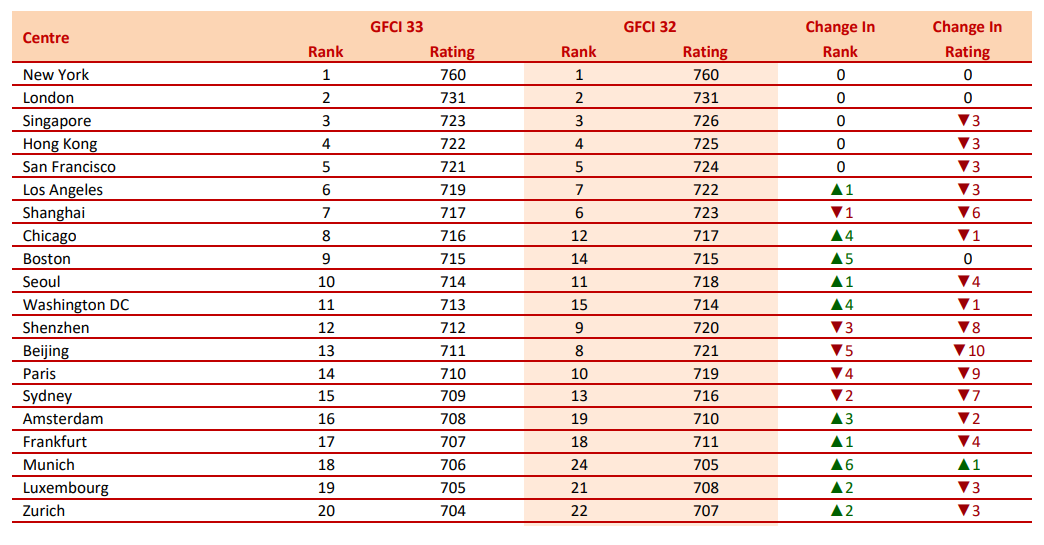

Z/Yen in London and the China Development Institute (CDI) in Shenzhen collaborated to publish the 33rd edition of the Global Financial Centres Index (GFCI 33). Overall, the top five financial centres continue to be New York, London, Singapore, Hong Kong and San Francisco.

Singapore continues to lead the region, one rating point ahead of Hong Kong. Chicago, Boston, and Seoul entered the top 10, replacing Paris, Shenzhen, and Beijing.

Performance in Asia/Pacific centres was again balanced as in GFCI 32, although the leading 16 centres in the region all fell in the ratings. A total of 11 among the remaining 14 centres in the region increased their rating. Overall, ratings for centres in Asia/Pacific rose slightly by 0.17% on average.

Leading Chinese centres fell back a little. Shanghai dropped one place to the 7th position. Shenzhen (-3), Beijing (-5), Guangzhou (-9), Chengdu (-10) and Taipei (-8) are also falling in the rankings. On the other hand, Dalian (+8), Nanjing (+8), Tianjin (+8), Hangzhou (+5), Xi'an (+13) and Wuhan (+8) saw improvement in their ranks.

Rankings of other Asian cities:

- 21st:Tokyo (-5)

- 37th: Busan (-8)

- 38th: Osaka (-1)

- 58th: Kuala Lumpur (-2)

- 61st: Mumbai (+9)

- 65th: New Delhi (+3)

- 71st: Bangkok (+8)

- 83rd: Jakarta (+12)

- 108th: Manila (-5)

- 112nd: Ho Chi Minh City (-8)

When asked which centres respondents consider will become more significant over the next two to three years, Seoul, Singapore, Kigali and Hong Kong were mentioned the most.

Hong Kong's rankings in the four areas of business environment, infrastructure, financial sector development, and reputational and general rose by two places as compared with the previous issue. A spokesperson of the HKSAR government said this fully reflects Hong Kong's strengths and advantages as a leading global financial centre.

"In view of the intense international competition, the Government has adopted a more vigorous and proactive development approach to press ahead with institutional enhancements and policy innovations as well as boosting promotion and publicity on Hong Kong's full return to normalcy, so as to consolidate our strengths and continuously enhance the competitiveness of Hong Kong," said the spokesperson. "We are confident that the financial system of Hong Kong can withstand external shocks and remain resilient."

The report also showed the most important factors that people in finance consider when deciding where to start up a new financial business, which are:

- Access to customers,

- Trusted legal and arbitration system,

- Openness of the economy,

- Quality of the regulatory systems.

In addition, respondents identified access to finance and ICT infrastructure as the leading elements in generating a competitive environment for FinTech providers. Payment transaction systems, cyber security, and big data analytics were identified as the most important areas of Fintech activity.

The GFCI is updated every March and September, which continues to provide evaluations of competitiveness and rankings for the major financial centres around the world.

Lead image / Shutterstock

Chart / Global Financial Centres Index (GFCI 33)

share on