share on

Remuneration remains the most important motivation for professionals to consider switching jobs, but companies also need to take note of other benefits desired, such as housing benefits and share-based awards.

Upon resumption of normalcy, Hong Kong is experiencing increased optimism in the business sector in 2023, resulting in higher-than-expected headcount demand from employers that will drive career opportunities and higher salaries, according to the latest report by KPMG China.

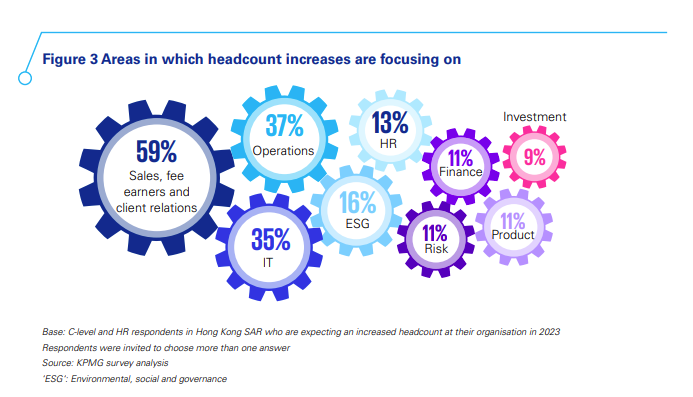

The report showed that Hong Kong's employment market is expected to maintain momentum in 2023. More than a third (37%) of all business executives and professionals surveyed expect staff numbers at the Hong Kong operations of their organisations to increase in 2023, up from 35% in 2022. Optimism is even higher among C-level and HR respondents, with the percentage rising to 44% in 2023 from 40% in 2022.

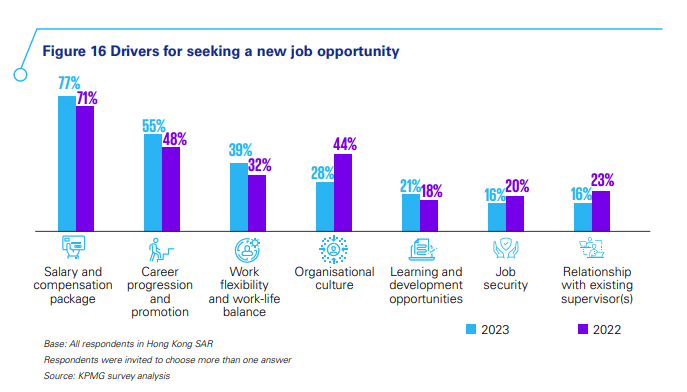

Remuneration remains the most important motivation for professionals to consider switching jobs. Expectations for salary increments when changing jobs remain high among respondents to the survey.

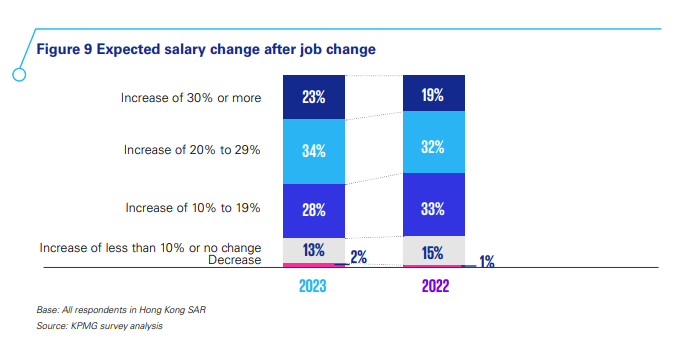

Salary increases after job changes remained at elevated levels in 2022, with the average increase amounting to 23% (2021: 23%, 2020: 19%). The highest salary increments in 2022 were achieved by C-level respondents and assistant managers or below – the average pay rise after a job move being 30% for both these levels.

The higher salaries achieved after job changes in 2022 appear to have driven up expectations for 2023. According to the survey, there is a four-percentage point increase in respondents expecting increases of 30% or more, while expected increases of 20% to 29% are up by two percentage points. This suggests that pressure on salary budgets will remain high in 2023, with companies needing to offer sizeable pay increases to attract the talent they require.

Salary reviews used as part of retention strategy

In Hong Kong’s active employment market, retention has become a key focus for organisations. According to the report, just under a quarter of surveyed respondents from Hong Kong (23%) changed jobs in 2022, which was down slightly than 2021 (27%).

The reported stated that more employers are being cautious about recruiting candidates that have changed jobs in recent years. Similarly, candidates would prefer to settle down rather than adapt to a new environment again. On the other hand, the lower turnover may also reflect the apparent success of companies’ retention strategies, with candidates happy to stay put after receiving a counter-offer or being satisfied with their current role following their salary review.

During 2022, 73% of surveyed Hong Kong professionals that remained with their employer were rewarded with a pay increment (compared to 50% in 2021). The most common increase was in the 3% to 5% range, however one in five respondents (19%) secured a pay rise of 16% or more following their review.

On bonus side, overall there was a modest increase in the prevalence of short-term incentive payments in 2022, with 73% receiving a bonus (2021: 69%). In addition, employers were slightly more generous with their bonus payments: the average bonus payment received was the equivalent of 2.43 months of salary, up from 2.21 in 2021.

The survey also found that salary expectations for 2023 will continue their upward trend. Three in four (74%) of respondents expect an increase in salary in 2023, compared with 66% in the previous year. However, bonus expectations for 2023 have moderated slightly, with 44% of respondents expecting an increase compared with 48% last year.

Other benefits

While remuneration is important, companies also need to take note of the other benefits desired by employees.

Hong Kong professionals adopted flexible work arrangements during COVID-19 and expect these work practices to continue now that the situation has improved. Close to three-quarters (74%) of survey respondents rated flexible working among their top five most important benefits, yet only 49% of Hong Kong employers offer such benefits.

Work flexibility and work-life balance moved up to become the third most important motivation to switch jobs, after salary and compensation packages, and career progression and promotion. Flexibility and balance are therefore aspects that would allow an organisation to differentiate itself in the employment market or, if not offered, could contribute to higher employee turnover.

Greater Bay Area opportunities

The potential of the employment market in the Greater Bay Area (GBA) has come into sharper focus over the last few years. With the Chinese Mainland having reopened its borders with Hong Kong in early 2023, following three years of travel restrictions, there is a sense that developments in the region will start to accelerate. In that respect, there have recently been a number of government-led initiatives that should provide a boost to talent relocating across the region over the coming years.

Career prospects remain an important draw when considering opportunities in GBA. Respondents to the survey have positive views about the opportunities that the GBA currently offers. Among all respondents, nearly three-quarters (73%) indicate that they would consider relocating within GBA cities or to the region to pursue job opportunities.

Top three motivations for working in GBA cities:

- Better career and industry prospects (78%),

- Broader work exposure (63%),

- Higher income (63%).

Innovation and technology (62%) and financial services (40%) were highlighted by respondents as the industries that are expected to create the most jobs in the GBA. Trade, supply chain, and logistics (36%), was noted as the third key sector for job creation.

“The Chinese Mainland’s new multi-entry visa scheme that will allow highly-skilled talent to travel freely across the GBA, not only indicates that there is broad-based agreement on the long-term career potential of the region, but also creates a wider talent pool across the area," said David Siew, Partner, People Services, KPMG China.

"Businesses may consider having a mobility policy in place to encourage skilled personnel to move and work in different cities to engage with a wider group of talent-building economic activity.”

In addition, on the employment and talent trends in Hong Kong and Greater Bay Area, Bing Li, Head of APAC, Bloomberg, noted that there's some short-term volatility among some of the financial institutions around hiring in Hong Kong - but that varies from one institution to the next. As such, he said it's too early to claim any sort of long-term trend.

He shared further: "In terms of the Greater Bay Area, the message we consistently hear from our counterparts at banking and technology firms is that there is robust demand for talent - especially as Asia's fintech sector matures. I don't see any reason for that trend to change. Most likely, the Greater Bay Area will be a primary magnet for global finance and technology talent for years to come."

"The long-term challenge for this region is going to be awareness. We have thriving banking and technology sectors here, but it will require a concerted and consistent push from employers in Asia to drive global awareness of GBA as a destination for top-tier talent and as an innovation hub," he concluded.

KPMG China’s 2023 report titled Hong Kong Executive Salary Outlook 2023 surveyed 1,327 business executives and professionals to measure the employment trends in Hong Kong and across the GBA. Among these, 645 respondents work or have a home base in Chinese Hong Kong and 682 respondents work or have a home base in the Chinese Mainland. The research covered areas including latest headcount expectations, salary and bonus outlook, and other talent trends. Among the Hong Kong respondents, just under half of all respondents (47%) held leadership positions at the C-level or as department head.

Lead image / Shutterstock

All infographics / KPMG China’s 2023 report titled Hong Kong Executive Salary Outlook 2023

share on