share on

New York continues to lead for four years, followed by London, Singapore, Hong Kong and San Francisco.

Z/Yen in London and the China Development Institute (CDI) in Shenzhen collaborated in publishing the 32nd edition of the Global Financial Centres Index (GFCI 32) on 22 September 2022 (Thursday). Overall, Singapore climbed three places, overtaking Hong Kong to the 3rd spot, while Hong Kong, on the other hand, dropped one place to the 4th position.

New York continues to lead for four years, while London and San Francisco are ranked 2nd and 5th respectively.

Performance in AsiaPacific centres was balanced, with half of these centres maintaining or improving their rank, and half falling in the rankings.

Financial centers in China continue to rise. Hong Kong, Shanghai, Beijing and Shenzhen are now among top 10 global financial centers. Guangzhou (25th), Chengdu (34th) and Qingdao (36th) also make it into the top 50, while Taipei takes the 55th spot.

For ASEAN region, Kuala Lumpur is ranked at 56th, India's cities New Delhi and Mumbai are respectively ranked at 68th and 70th. Bangkok, Jakarta, Manila, and Ho Chi Minh City take the 79th, 95th, 103th and 104th positions respectively.

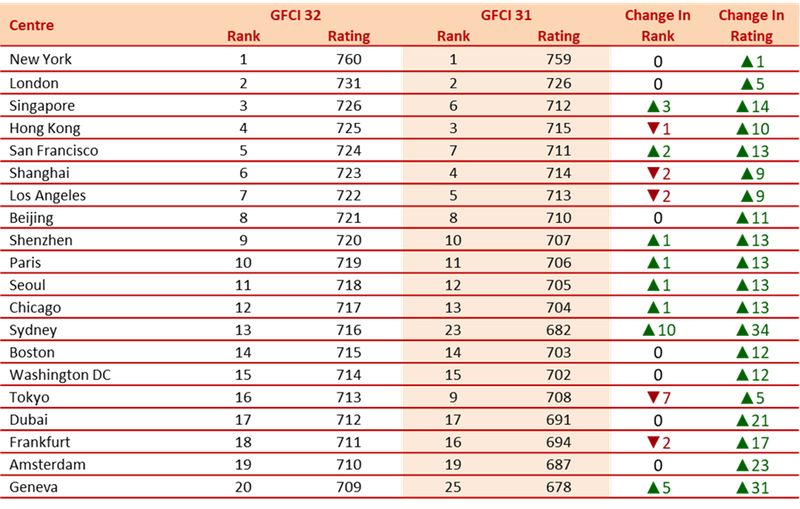

The top 20 global financial centres are:

Overall the average rating of centres in the index improved 4.83% from GFCI 31, regaining the average ratings last recorded in GFCI 27 in March 2020. The report stated: "This suggests that there is confidence in financial centres themselves, even against a background of the Russian war in Ukraine, economic and energy instability, and inflationary pressures."

Asking about which factors of competitiveness they consider the most important at this time, most of the respondents indicated business environment, followed by human capital, infrastructure, taxation, reputation, and financial sector development.

The report also researched the most important factors that people in finance consider in deciding where to start up a new financial business. The three leading factors are "access to customers", "a trusted legal and arbitration system", and " the openness of the economy".

In addition, the development of several centres over the next two to three years is worth noting, such as Seoul, GIFT City - Gujarat (Gujarat International Finance Tec-City), and Kigali.

Respondents also revealed their desirable places to work if they needed to live and work in a different city. New York heads the list, while London, Hong Kong, Singapore and Abu Dhabi come thereafter.

The GFCI 32 uses 66,121 financial centre assessments collected from 11,038 financial services professionals, with quantitative data about each financial centre which form instrumental factors, to rate 119 financial centres across the world.

Image / Shutterstock

Follow us on Telegram and on Instagram @humanresourcesonline for all the latest HR and manpower news from around the region!

share on

Follow us on Telegram and on Instagram @humanresourcesonline for all the latest HR and manpower news from around the region!

Related topics