share on

This rebound reflects Singapore’s strong economic recovery amid a tight labour market where firms continue to compete for workers.

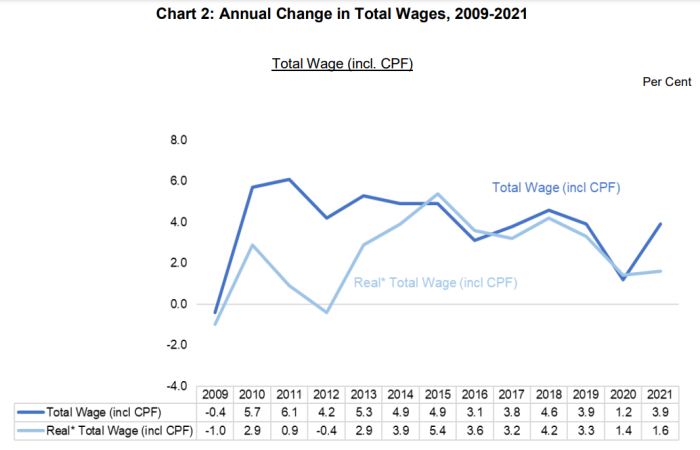

Singapore's wage situation improved in 2021 compared to the previous year, with both nominal and real wage growth higher in 2021 than in 2020.

The Ministry of Manpower’s 2021 Wage Practices Report also foresees continued growth in wages in 2022, as the labour market is expected to remain tight, and firms compete for workers. However, supply chain disruptions and "uncertainty arising from the prolonged Russia-Ukraine conflict" could potentially affect business confidence and slow the rate of growth.

At the same time, with recent shocks to the global supply chains, inflation is projected to stay elevated and dampen real wage growth.

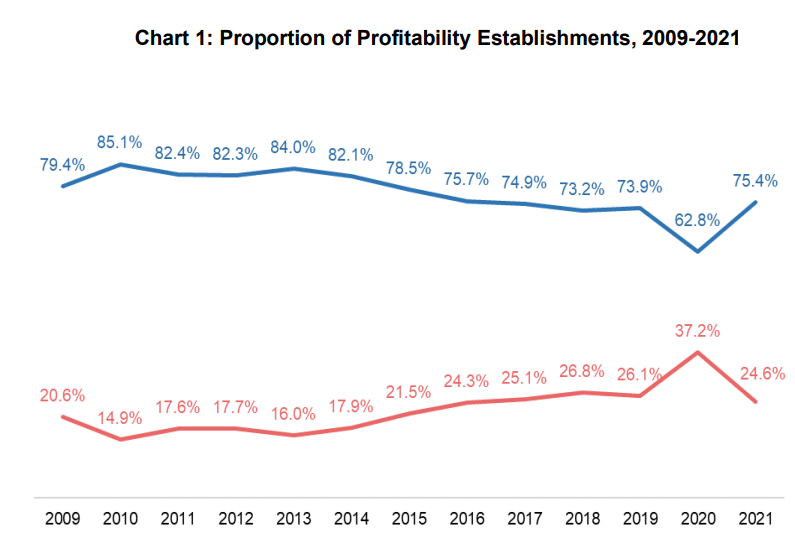

Profitability on the rise

Amidst strong economic recovery in 2021, the proportion of profitable establishments increased to 75% in 2021 from 63% in 2020 as seen below. Growth in the proportion of profitable establishments was observed across most sectors.

Nominal wages of resident employees rose by 3.9% in 2021. This increase is more than double the decade low of 1.2% in 2020, and within the range of the pre-COVID years of 2018 to 2019 (3.9% to 4.6%).

Wage growth in 2021 was lower than that in 2010 (5.7%) during the post-Global Financial Crisis recovery. This is reflective of the uneven recovery across sectors. Additionally, some establishments may have been more cautious in raising wages given the greater uncertainty brought about by the pandemic. The report said, "as COVID-19 had a less severe impact on wages compared to the GFC, wage growth also had less ground to recover in 2021 compared to 2010."

While prices have risen, nominal wage growth more than kept pace with inflation, allowing real wages to grow. However, the pace of growth was considerably dampened. Real wage growth was noted at 1.6%, only slightly above that of 2020 (1.4%) and lower than 2019 (3.3%).

Shown in the chart below, more establishments gave wage increases in 2021 (60%) compared to 2020 (52%). That being said, the proportion was still lower than in 2019 (69%). This suggests that with the uneven recovery in 2021, some establishments were slower in picking up from the impact of the pandemic. Establishments that gave wage cuts remained the minority at 6.8%. The remainder of 33% left wages of their employees unchanged.

A similar observation was made for wage change among employees.

Among establishments that gave wage increases, the magnitude of increase was higher in 2021 compared to 2020 and pre-pandemic 2019. Among establishments which gave wage cuts, the magnitude of wage cuts was less steep in 2021 than in 2020. However, the cuts were still higher than in 2019. This is again reflective of the uneven recovery across sectors.

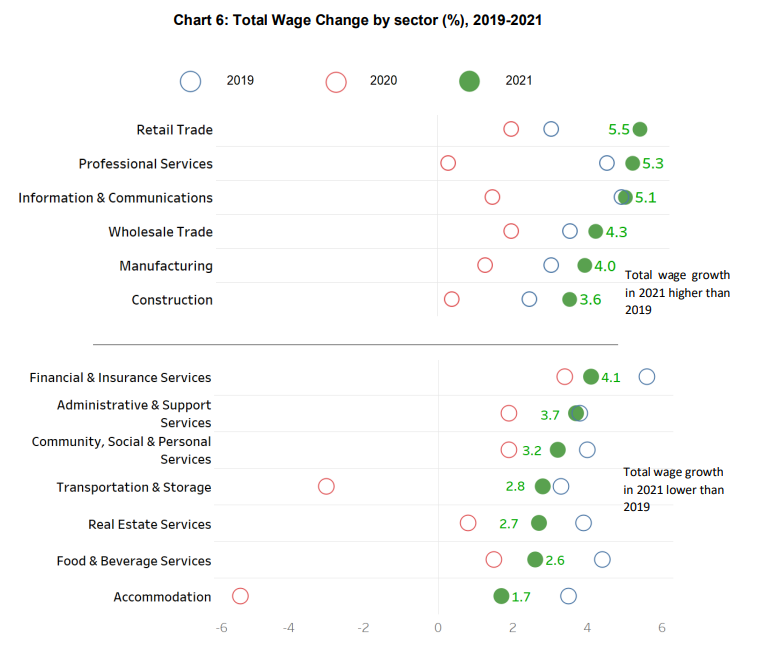

Wage changes by sector

In 2021, all sectors experienced higher total wage growth compared to 2020 as depicted below.

The magnitude of wage change was varied across sectors as some sectors have not fully recovered from the impact of the pandemic.

Particularly, information & communications (which observed total wage change of 5.1%), financial and insurance services (4.1%), and manufacturing (4.0%), continued to see strong wage increases in 2021. These sectors were less affected by the pandemic and have been seeing sustained GDP growth since late 2020. Wage growth for information & communications and manufacturing was also higher than pre-pandemic rates in 2019.

Sectors that were severely affected by the pandemic also recovered to register wage increases, namely:

- Accommodation (2020: -5.3%, 2021: 1.7%)

- Transportation & storage (2020:-3.0%, 2021: 2.8%)

- Food & beverages services (2020: 1.5%, 2021: 2.6%)

However, the increases were generally lower than growth sectors and pre-pandemic growth rates. With further easing of domestic safe management measures and border restrictions, wages in these sectors are expected to pick up in 2022.

Commenting on the findings, NTUC Assistant Secretary-General Desmond Choo expressed that he is "encouraged" by the latest wage growth statistics, "of which the trends reported in the report are largely similar to NTUC’s data and sensing on the ground".

He added: "Companies adjusted wages in part due to confidence of a better outlook for 2022, partly to retain and attract manpower in an increasingly tight labour market and in preparation for recovery. Companies also paid in recognition of the sacrifices workers made in 2020 and the extra workload with lesser manpower, with restoration of wages of workers in the severely impacted sectors having started in Q1 2021."

Looking forward, Choo spoke on making the wages market competitive and relevant for the longer term.

Keeping in mind "it is early days yet", he emphasised that one way to do so is for business to maintain a skilled and engaged workforce. "Companies would need to accelerate job transformation in alignment with wage and skills developments in the labour market, and a core part of this is to focus on driving productivity to make sure that wage increases are sustainable and that we can keep ahead of inflation.

"Workers across the occupational spectrum must continue to upskill themselves to not just safeguard personal job security, but also be ready to capture opportunities in the accelerating changes to the world of work and technological changes."

He advised: "More importantly, employers must continuously review their compensation objectives and perform the necessary market adjustments to job salary ranges to ensure that the employees’ wages across the occupational spectrum remain relevant and competitive, and workers are paid wages commensurate with their skills, contributions, and experiences."

All images / Ministry of Manpower 2021 Wage Practices Report

Follow us on Telegram and on Instagram @humanresourcesonline for all the latest HR and manpower news from around the region!

share on

Follow us on Telegram and on Instagram @humanresourcesonline for all the latest HR and manpower news from around the region!

Related topics