Follow us on Telegram and on Instagram @humanresourcesonline for all the latest HR and manpower news from around the region!

share on

It's going to be a busy quarter for MOF, as it wraps up the last quarterly tranche for 2022 on the GST Vouchers for Singaporean households living in HDB flats.

Singaporean households are set to benefit from a slew of financial support measures as we start 2023, with the first one due on 3 January 2023, when every local household will receive a total of S$300 Community Development Council (CDC) Vouchers. This comprises S$200 CDC Vouchers under the Assurance Package (AP) and S$100 CDC Vouchers from the S$1.5bn Support Package announced in October 2022.

All figures mentioned are in Singapore dollars (SGD).

With the Goods and Services Tax (GST) increase to 8% as of 1 January 2023, support measures to help defray GST and other living expenses are also underway. Here's what Singaporean households can look forward to, as well as calculate how much support they may be getting, in three types of payments - cash & MediSave, U-Save, and Service and Conservancy Charges (S&CC) Rebate.

Cash and MediSave support

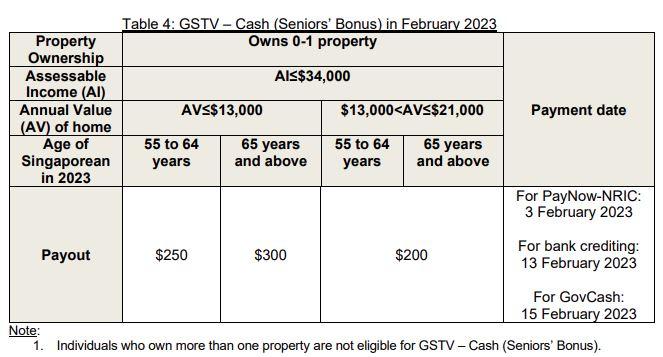

In February 2023, lower-income senior Singaporeans aged 55 years and above will receive up to $300 cash, under the GSTV – Cash (Seniors’ Bonus).

Also in February 2023, eligible senior Singaporeans aged 55 years and above, and Singaporean children aged 20 years and below will receive $150 in their CPF MediSave Account under the AP MediSave.

U-Save support

The exact amount of U-Save rebates depends on the type of HDB flat households are living in.

In FY2022, eligible households received double their regular U-Save rebates. This amounts to about eight to 10 months’ worth of utility bills for the average household living in one- and two-room HDB flats, and about four to six months’ worth of utility bills for the average household living in three- and four-room HDB flats.

This is how you can calculate the amount you may be getting:

The AP U-Save will be provided in specific quarters starting from January 2023 and ending in January 2026.

S&CC Rebate support

Eligible households will receive GSTV – S&CC rebates to offset between 1.5 and 3.5 months of their S&CC each year. The exact amount depends on the type of HDB flat they are living in.

This is how you can calculate the amount you may be getting:

In FY2022, eligible households received double their regular U-Save rebates. This amounts to about eight to 10 months’ worth of utility bills for the average household living in one- and two-room HDB flats, and about four to six months’ worth of utility bills for the average household living in 3- and 4-room HDB flats.

The GSTV – S&CC rebates are credited directly into households’ S&CC accounts managed by their respective Town Councils. Households do not need to take any action to benefit from the rebates.

About 950,000 Singaporean households living in HDB flats are expected to benefit from the GST Voucher (GSTV) – U-Save and Service and Conservancy Charges (S&CC) rebates in January 2023. These rebates conclude the fourth quarterly tranche for FY2022, with previous handouts made in April, July, and October 2022.

In addition to the GSTV – U-Save and S&CC rebates for eligible households, every Singaporean household would also have received a one-off $100 Household Utilities Credit (HUC) by September 2022. The HUC is part of the $1.5bn package announced in June 2022 to help Singaporeans cope with higher inflation.

Lead image / Government of Singapore

In-line infographics / SG Press Centre

share on

Follow us on Telegram and on Instagram @humanresourcesonline for all the latest HR and manpower news from around the region!

Related topics