share on

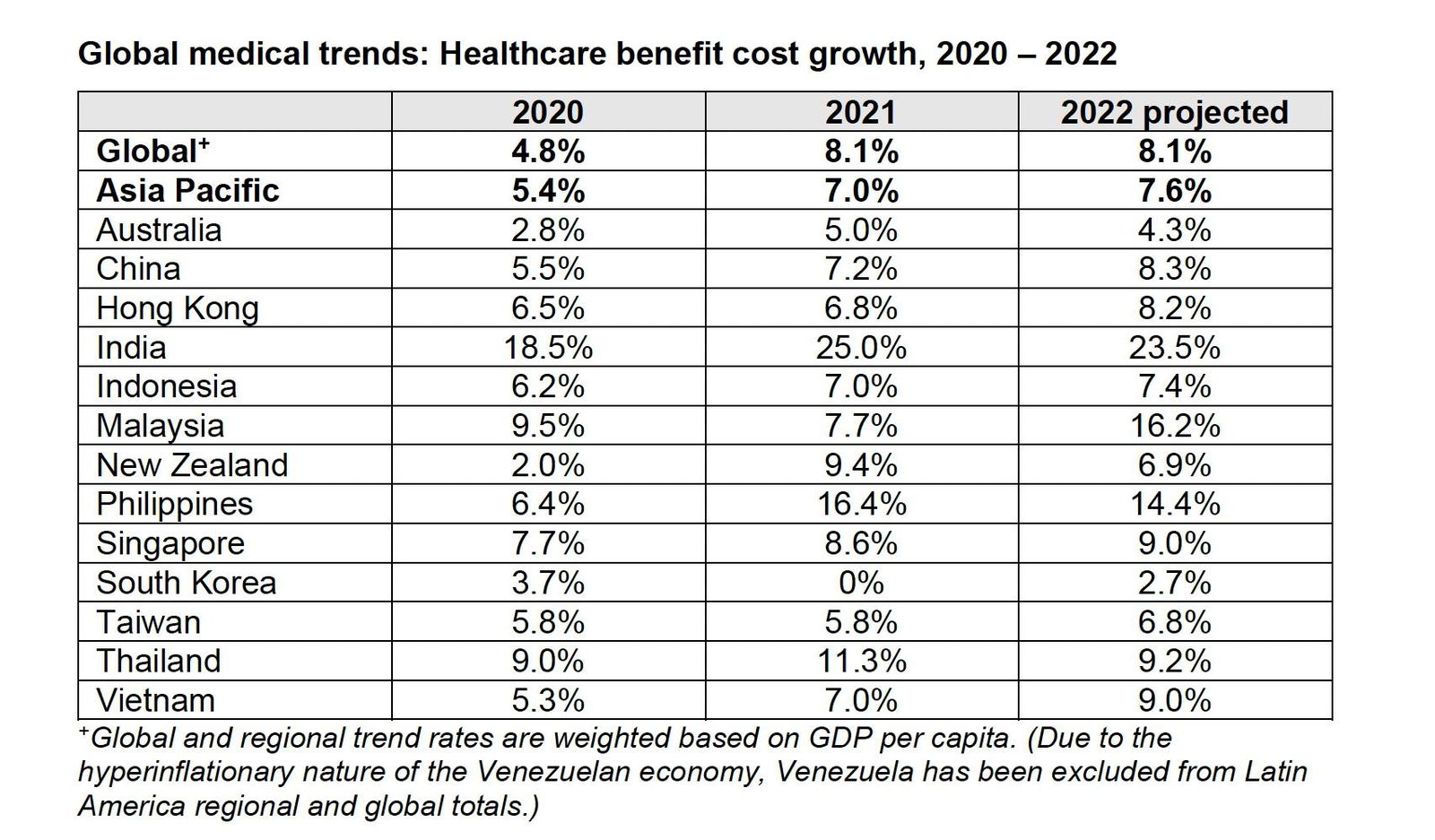

This is because across APAC, insurers are expecting cost trends to rise - as high as 9% in Singapore; 7.4% in Indonesia; 14.4% in the Philippines; 9.2% in Thailand; 9% in Vietnam, and 23.5% in India.

Employer-sponsored healthcare benefit costs are expected to increase by 7.6% on average in Asia Pacific (APAC) in 2022, according to Willis Towers Watson's (WTW) latest 2022 Global Medical Trends Survey. This is a continuing trend as the projected healthcare benefit costs declined in 2020, before rebounding to 7% in 2021.

The reasons why employee healthcare costs are expected to rise include the following:

- Overuse of care (64%) due to medical professionals recommending too many services or overprescribing;

- Excess of care by insured members (59%), and

- Underuse of preventive services (38%) due to the avoidance of medical care during the pandemic.

The report stated: "With COVID-19 surging in different countries at various times in 2020 and 2021, survey results showed the pandemic’s asymmetrical arc created considerable volatility in healthcare utilisation and costs around the world."

Willis Towers Watson conducted this survey among 209 insurers representing 61 countries, including 13 markets in Asia Pacific.

Cedric Luah, Head of Health and Benefits, International, WTW, said: "COVID-19 has produced the biggest impact to global medical trend variation the industry has seen, and we expect the resultant repercussions and volatility to extend into 2022 and beyond.

"Markets and employers are feeling the impact differently. Some have experienced the recovery’s demand for regular medical services in 2021, while others will see it next year or after. The pandemic, combined with the changing face of work, has had a significant effect on healthcare needs, delivery of services and the future drivers of medical claims, which in turn will have impact on medical inflation trends."

What about Malaysia?

Looking at the Malaysian market, the survey found that:

- Elective medical procedures are expected to return since many were postponed due to the pandemic.

- Medical tourism is expected to pick up in early 2022, once the international travel ban is lifted,

These observations are backed by the upward trend of Malaysia's vaccination rate in 2021, and the resumption of interstate travel, along with a host of economic activities which, explained in the survey, is expected to "bring a large degree of normalcy back into everyday life".

Diving into the numbers, it was revealed that Malaysia's healthcare benefit cost in 2022 is projected to be as high as 16.2%—this is approximately twice as high as the percentage in 2021 (7.7%), as well as 2020 (9.5%).

Malaysia versus APAC

When comparing specific markets in APAC, the survey shared that insurers are expecting cost trends to be as high as 9% in Singapore; 7.4% in Indonesia; 14.4% in the Philippines; 9.2% in Thailand; 9% in Vietnam, and 23.5% in India.

For India, the country with the highest projected cost in APAC, it is mainly attributed to how the nation is currently at an early stage of implementing regulations on the treatment and pricing protocol of medical care for COVID-19, for instance. Thus, on top of challenging hospital billing practices, non-COVID-19 deferred claims are rising, and the average cost of procedures is gradually increasing due to the impact of providers implementing COVID-19 protocols.

As for Singapore's figures, the 2022 Global Medical Trends Survey explained it could mainly be due to the higher utilisation of medical services, a residual impact of delayed elective surgical procedures caused by the surge in COVID-19 cases in Singapore government hospitals.

Beyond that, there is also a key employer focus on the mental wellbeing of employees. As such, the healthcare system has also pivoted to include virtual mental wellbeing support, largely to ensure that employees receive the quality telehealth support they need as they continue to work from home. Employers are therefore reviewing how wellbeing solutions, in general, can be incorporated as a core benefit item, seeking support from insurers.

"It is likely that the adoption of telehealth will continue post-pandemic. In fact, the role of telehealth will continue to evolve not only as a digital platform for ease of access to the right care but also as an effective way to close the gap in accessing healthcare services.

"In addition, we expect the scope of services provided by these health-tech providers to expand further into wellbeing offerings, including but not limited to mental health services, given the impact of COVID on the emotional wellbeing of employees," Luah added.

ICYMI: Employers in APAC increasingly want to revamp their employee benefit programmes

Images / WTW

Follow us on Telegram and on Instagram @humanresourcesonline for all the latest HR and manpower news from around the region!

share on