share on

Singapore's Deputy Prime Minister and Minister for Finance Heng Swee Keat delivered a fourth Budget in Parliament today (26 May), to further support the country in fighting COVID-19.

In his speech, Minister Heng highlighted the Ministry of Trade and Industry's GDP growth forecast that was released this morning, which went from -4% to 1%, to -7.% to -4.% in outward-oriented sectors such as manufacturing, wholesale trade and transportation and storage. Separately, resident unemployment rate also rose to 3.3% in March, the highest the nation has seen since 2009.

Thus, the Government has introduced the S$33bn Fortitude Budget, which focuses on jobs, support for households and communities, and further resourcing frontline agencies to fight COVID-19. Minister Heng called this "landmark package, a necessary response to an unprecedented crisis."

Key highlights for HR and employers to note are summarised below:

Supporting businesses through the 3Cs - cashflow, cost, credit

As part of this new Budget, the Government will further strengthen its support towards businesses in the 3Cs of cashflow, cost, and credit.

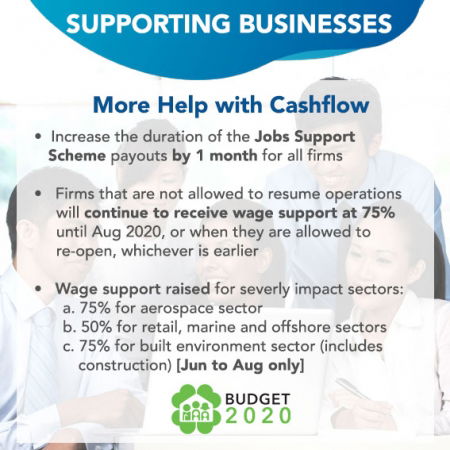

Cashflow: Jobs Support Scheme payouts to be extended by one month for all firms

In providing relief for firms that are preparing to open post-Circuit Breaker, the Government will extend the Jobs Support Scheme (JSS) for an additional month for all firms. This payout will be given based on wages that have been paid in August 2020, and firms can look forward to receiving it in October 2020.

At the same time, firms that are unable to re-open right away will continue to the 75% support for wages up till August or when they are allowed to re-open, whichever is earlier. These include retail outlets, gyms and fitness studios, and cinemas.

Additionally, the Government will move to refine the classification of firms in the different JSS tiers, following feedback from industry associations and businesses, Minister Heng shared.

- The Government will increase the level of support for firms in more severely-impacted sectors, from 25% to either 50% o4 75%.

- The aerospace sector will receive 75% of wage support;

- While the retail, marine and offshore sectors will receive 50% of wage support.

- Eligible firms in these sectors will receive back-payments in July, to top up the previous JSS payouts to a higher level of support.

- The built environment sector, which includes construction, will also receive a higher percentage of wage support, at 75%.

- This support will only apply to wages paid between June and August.

All these enhancements to the JSS will amount to S$2.9bn, while in total, the entire scheme will amount to S$23.5bn given out to firms within 10 months. Minister Heng encouraged business leaders to "make full use of the schemes available to train workers and upgrade your corporate capabilities."

Cost: Foreign worker levy waiver and rebate to be extended for selected businesses

Minister Heng also announced that the foreign worker levy waiver and rebate to support employers of migrant workers, who have had to suspend operations. This will be extended by two months, and will apply to businesses in construction, marine and offshore, and process sectors that are affected; these businesses will receive 100% of the waiver in June, and 50% in July. As for the rebate, businesses will receive S$750 in June, and S$375 in July.

Cost: Deferment of planned increase in CPF contribution rate for seniors

In further helping businesses manage costs, the Government will defer the planned increase in CPF contribution rates for senior workers by one year from 1 January 2021 to 1 January 2022. The CPF transition offset scheme will also be deferred until after the higher contribution rates take effect.

Apart from this, a S$2bn cash grant will also be given to property owners, in helping offset the rental costs of their SME tenants. This grant will automatically be disbursed to property owners from end-July.

Additionally, the Minister for Law will be introducing a new Bill next week, which will mandate that landlords contribute by granting a rental waiver to SME tenants who have suffered a "significant revenue drop in the past few months."

At the same time, other SMEs in the industrial and office sectors will also receive some relief, while Government tenants will also receive additional rental waivers.

Credit: Additional support for promising start-ups

To bridge the financing gap for promising start-ups, the Government will set aside S$285mn to "catalyse and crowd in another $285 million or more in matching private investments." This is in addition to the S$300bn that the Government previously set aside under the Unity Budget, for deep-tech start-ups to gain better access to capital expertise and industry networks.

Aside from the above, Minister Heng highlighted that the Government will provide additional aid to sectors that will take longer to re-open fully - for instance aviation, maritime, and tourism, and will introduce further support for the built environment sector.

Supporting businesses in digital transformation through an additional S$500mn

Indeed, COVID-19 has done what many CEOs and CTOs had yet to do - accelerate digitisation," Minister Heng shared.

In supporting businesses, especially the less digitally savvy that have been hit hard during the Circuit Breaker, the Government will allocate an additional $S500mn in supporting their digital transformation.

- A new Digital Resilience Bonus will help businesses in taking the next step forward. Eligible businesses will receive a payout of up to S$5,000 if they adopt PayNow Corporate and e-invoicing, as well as business process or e-commerce solutions. An additional tier of $5,000 will be given to F&B and retail businesses that incorporate advanced solutions.

- A separate S$250mn will be set aside to help businesses digitalise and mitigate the impact COVID-19 has had on their revenue.

- Hawkers, coffeeshops, wet markets and industrial canteens will receive a S$300 bonus each month over a period of five months, to encourage them to implement e-payments. This will be jointly provided by the IMDA, NEA, JTC Corporation, Enterprise Singapore, and HDB.

More details can be found here.

Supporting workers by creating jobs, upskilling for the future

The Government has set aside S$2bn for the new SGUnited Jobs and Skills Package, which aims to create close to 100,000 opportunities in jobs, traineeships, and skills training.

This will build on employment and training support that has been provided through the SkillsFuture movement and the Adapt and Grow initiative, including enhancements announced in the 2020 Unity and Resilience Budgets.

- The number of job opportunities in both the private and public sectors will be expanded to more than 40,000, with the public sector offering 15,000 jobs in areas such as early childhood education, health, and long-term care. Government agencies will also work with businesses to create 25,000 jobs.

- Further, the SGUnited Traineeships Programme aims to create 25,000 traineeships, while a new SGUnited Mid-Career Traineeships scheme will provide an additional 4,000 traineeships for unemployed mid-career jobseekers.

- A new SGUnited Skills Programme which aims to expand training capacity will provide stronger support for up to 30,000 jobseekers in 2020.

- The hiring incentive under the SkillsFuture Mid-Career Support Package will also be enhanced to support employers’ hiring needs.

- For eligible workers aged 40 and above, the Government will double the incentive to cover 40% of their salary over six months, capped at S$12,000 in total.

- Together with other support such as the special SkillsFuture Credit top-up of

S$500 to every Singaporean aged 40 to 60 in 2020, there will also be enhanced support for jobs and training for this group. If needed, they can also benefit from other support schemes this period, such as the COVID-19 Support Grant. - At the same time, for eligible workers under 40, this incentive will cover 20% of their monthly salary over six months, capped at S$6,000 in total.

More details on the SGUnited Jobs and Skills Package can be found here.

Supporting workers and SEPs with additional funding from the COVID-19 Support Grant

The COVID-19 Support Grant, which covers those who have lost their jobs, are placed on no-pay leave, or face significantly reduced salaries in the coming months, will see an additional S$800mn in to-up in further support efforts.

Additionally, self-employed persons (SEPs) will be provided with direct cash assistance through the Self-Employed Person Income Relief Scheme. Over 100,000 self-employed persons will be receiving their first payout of S$3,000 this week.

Those who do not automatically qualify or have marginally missed the criteria can approach NTUC for assistance, Minister Heng added.

"I also encourage all self-employed persons to make full use of the SEP Training Support Scheme to train and upskill. Some self-employed persons are re-assessing their career options, looking at industries which are hiring. We will support you to access training programmes to make the transition."

Photo / DPM and Minister for Finance Heng Swee Keat's Facebook page

Infographics / MOF's Facebook page

share on