share on

While progress is seen in the region, the rate of adoption remains low and points to leaders needing to be upskilled on the topic so they can effectively make an impact.

A study by PwC Singapore and the Centre for Governance and Sustainability (CGS) at the National University of Singapore (NUS) Business School, has revealed that crucial reporting and disclosure gaps remain for businesses to demonstrate that they have a feasible and robust route of progression to reach net zero emissions by 2050.

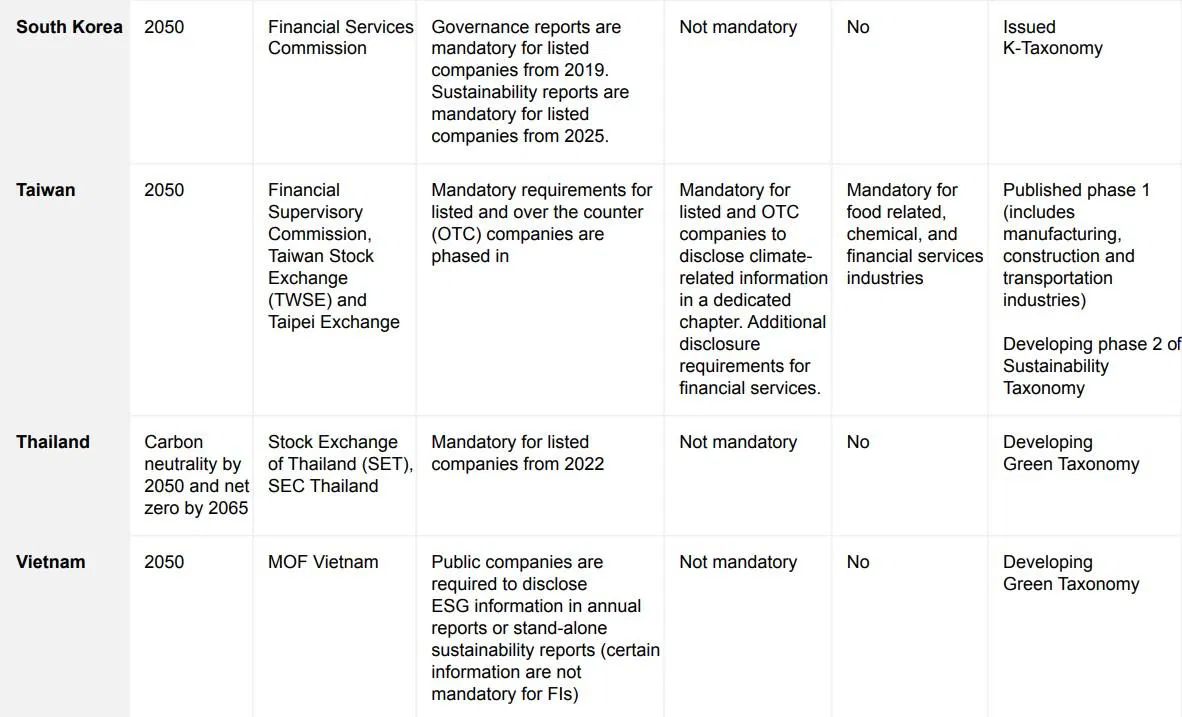

The study also highlighted the importance of sustainability reporting in Asia Pacific (APAC). As uncovered, in recent years, sustainability reporting has grown increasingly important to regulators across jurisdictions in the region, with requirements on such reporting either being implemented or planned to be implemented in most of the Asia Pacific jurisdictions studied.

For instance, it added, the Task Force on Climate-Related Financial Disclosures (TCFD) for climate reporting, established by the Financial Stability Board, has been especially useful, with seven out of 14 Asia Pacific jurisdictions studied planning to make or currently making TCFD reporting mandatory.

In addition, there have been more upcoming requirements for compulsory sustainability reporting assurance in APAC, with four jurisdictions mandating some form of assurance requirements. This is because quality data is critical for presenting authentic ESG information which is used for important decision-making in firms, the report affirmed.

More details on the jurisdictions, in relation to mandatory sustainability reporting and assurance requirements, can be found in the following table:

Mitigating ESG risks, keeping leaders upskilled

As pointed out, in order to achieve sustainable success, reliable sustainability reporting can allow for better integration of ESG into business strategy, risk management processes, and performance measurement. Not only would firms be able to mitigate ESG risks, but they will also be able to bring cost savings and create opportunities that generate long-term value creation.

With this in mind, the study noted an improvement in the current state of sustainability reporting, although there remains a lag in critical areas.

In particular, from 2021 to 2022, the disclosure of identified climate-related risks and/or opportunities in companies’ sustainability reporting increased from 77% to 88%. On a similar note, disclosure of processes for managing these risks and/or opportunities increased from 66% in 2021 to 74% in 2022. These jumps in disclosure rates were attributed to the adoption of the TCDF framework where such disclosures are a reporting component.

The findings also indicated that companies, compared to last year, are constantly readjusting their business strategies and models to address current climate issues, and changing stakeholder and regulator expectations. Presently, more than nine in 10 companies studied (92%) disclosed sustainability targets in 2022. However, only 51% have disclosed net zero targets, 42% of which reported that their net zero targets are based on the Science-Based Targets initiative (SBTi) framework and just 16% reported having their targets verified by SBTi, which is indicative of a scientific way for firms to achieve net zero emissions.

Considering that most APAC jurisdictions have committed to reaching net zero goals between 2050 to 2070, the results suggested that companies need to show more effort in their actions to fulfil their national sustainability agenda.

This brings to light a key point of action - keeping leaders upskilled. As cited in the study, 36% of companies studied reported their board of directors or management have attended or received sustainability training in 2022, an increase from 24% in 2021. However, while there has been progress, the rate of sustainability training remains low. Thus, the study encourages upskilling at the leadership level for firms to better manage their sustainability strategy, progress, and governance.

This, in turn, would allow leaders to efficiently discharge their responsibilities in managing material sustainability issues, which include strategy and risk management.

Professor Lawrence Loh, Director, CGS at NUS Business School, commented: "While we are encouraged by the increased disclosure of climate-related risks and opportunities, it is crucial to remain vigilant about critical gaps such as net-zero targets, transparency in emissions reporting and sustainability training.

"As expectations for ESG rise, companies must prioritise resolving these gaps and make the necessary resource commitments. They can then serve as exemplary enterprises on a successful green journey, embodying accountability and resilience."

About the study

The study focuses on the top 50 listed companies by market capitalisation across 14 selected jurisdictions in Asia Pacific, namely: Australia, China, Hong Kong, India, Indonesia, Japan, South Korea, Malaysia, New Zealand, Philippines, Singapore, Taiwan, Thailand, and Vietnam.

A total of 700 listed companies were studied, spanning 11 industries: communication services, consumer discretionary, consumer staples, energy, financials, healthcare, industrials, information technology, materials, real estate, and utilities.

The companies are identified as those listed on stock exchanges worldwide, and the information reviewed was based on the latest sustainability reports and annual reports available in January 2023. Only companies whose sustainability reports are communicated in English are included.

Thank you for reading our story! Please leave us a comment if you enjoy our content — take our 2023 Readers' Survey here.

Lead image: Provided

share on